China, Russia, Look To The Shia Power Crescent For Middle Eastern Leverage & Energy Investments

China’s BRI is making inroads into Iraq, Syria, Jordan, Lebanon & Yemen under a new regional strategy

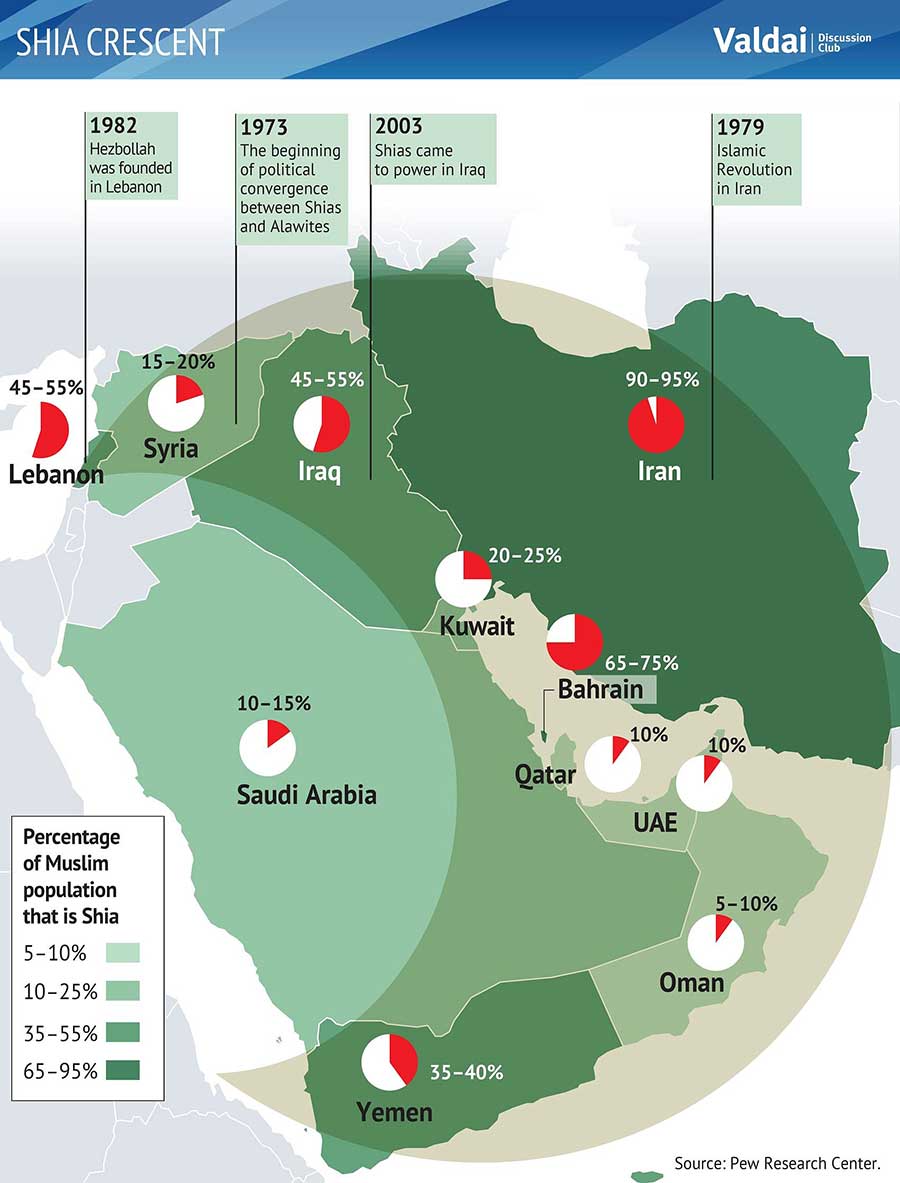

Crucial to China’s multi-pronged, multi-generational ‘Belt & Road Initiative’ power-grab project is the Shia Crescent of the Middle East. Named after the largest regional Muslim group the Shia, and dominated by Iran, China’s chief longstanding ally in the Middle East, the Shia Crescent of Power – also comprising Iraq, Syria, Jordan, Lebanon, and Yemen – allows China three key geopolitical advantages.

The Shia Crescent

The Shia Crescent (or Shiite Crescent) is the notionally crescent-shaped region of the Middle East where the majority population is Shia or where there is a strong Shia minority in the population.

In recent years the term has come to identify areas under Iranian influence or control, as Iran has sought to unite all Shia Muslims under one banner. On the other hand, this concept shows the increasing political weight of Shia in the Middle East.

Areas in the Shia Crescent include Lebanon, Syria, Bahrain, Iraq, Iran, Azerbaijan, Yemen, and western Afghanistan. In addition to the Twelver Shia, the term also includes Ismaili, Zaydi, Syrian Alawite, and Bektashi groups in Turkey.

The Geopolitical power this region bestows upon China is as follows.

First, it can be used to hold the U.S. in check in those areas. Second, it offers several direct transport routes into Europe that can be utilised overtly or covertly. Third, it has huge oil and gas reserves, many of which are currently going cheap. The recent signing by Iran’s President Ebrahim Raeisi and his Syrian counterpart Bashar al-Assad of a comprehensive plan for strategic and long-term cooperation, including oil and energy agreements, strengthen each of these factors for China and for its own broader geopolitical ally, Russia.

As part of the ‘Iran-China 25-Year Comprehensive Cooperation Agreement’ Iran’s then-First Vice President, Eshaq Jahangiri announced in August 2019 that his country had signed a contract with China to implement a project to electrify the main 900-kilometre railway connecting Tehran to the north-eastern city of Mashhad, close to the border with Turkmenistan.

Adjunct to this was the plan to extend this upgraded network to the northwest through Tabriz, home to a number of key sites relating to oil, gas and petrochemicals, and the starting point for the Tabriz-Ankara gas pipeline. Ultimately, the Mashhad-Tehran high-speed train link will be a key part of the 2,300-kilometre BRI rail route that links Urumqi, the capital of China’s western Xinjiang Province, to Tehran, and connecting Kazakhstan, Kyrgyzstan, Uzbekistan and Turkmenistan along the way. After that, the Chinese plan is to extend the railway links through Tabriz into Turkey and then Bulgaria, and then into the rest of southern Europe.

In addition to these Shia Crescent transport links, Iran – with China’s help – has been building out a pan-Shia Crescent/Middle Eastern power grid, with Tehran at the centre. This is based around oil, gas and electricity supplies, which allows not just for the installation of permanent infrastructure linking one country to another but also for the on-site presence of permanent ‘technical and security’ personnel, many of which are already – or will be – Iranian and Chinese.

Iran, Iraq & Jordan

In just the same way that Russia’s huge level of gas supplies to Europe gave it immense power across the EU, so Iran’s electricity and other power supplies will do the same in the Middle East. Roping in potential countries into this plan, initially through early hands of trade friendship such as Iranian ally Iraq offering oil supplies, for example – is a standard tactic for Tehran to achieve its aim, and deals announced between Iraq and Jordan are also illustrative in this context.

Another notable announcement has been the extension of a contract for Jordan to import crude oil from Iraq. Underpinning this agreement have been broader discussions about the future relationship between Jordan and Iraq and these have resulted in a contract being signed to connect the electric power grids of the two countries. By extension, this would provide a direct link between Jordan and Iran, which still supplies Iraq with gas and electricity for its power grid.

In 2020, Iran’s Energy Minister Reza Ardakanian stated that Iran and Iraq’s power grids had become fully synchronised to provide electricity to both countries via the new Amarah-Karkeh 400-KV transmission line. He added that Iranian and Iraqi dispatching centres were fully connected in Baghdad, the power grids were seamlessly interlinked, and that Iran had signed a three-year co-operation agreement with Iraq. In the meantime, Iraq’s then-Electricity Minister, Majid Mahdi Hantoush, announced that not only was Iraq working on connecting its grid with Jordan’s electricity networks through a 300-kilometre-line, but also plans were being finalised for the completion of Iraq’s electricity connection with Egypt within the next three years. This, in turn, he added, would be part of the overall project to establish a joint Arab electricity market.

Syria

For Syria, China’s main interest for some time has been to allow Russia to take the lead on the basis that this would enable Beijing a freer hand elsewhere in the Middle East, with a particular focus on countries offering transport and energy resource advantages to it. This said, Syria – under the Assad regime – still has four considerable advantages to the overall China-Russia-Iran alliance in the region.

First, it is the biggest country on the western side of the Shia Crescent of Power, which Russia has been developing for years as a counterpoint to the U.S.’s own sphere of influence that had been centred on Saudi Arabia (for hydrocarbons supplies) and Israel (for military and intelligence assets). Second, it offers a long Mediterranean coastline from which Russia could send oil and gas products (either its own or those of its allies, notably Iran) for export.

The main destinations were major oil and gas hubs in Turkey, Greece, and Italy or those into north, west and east Africa.

Third, it is a vital military hub, with one major naval port (Tartus), one major air force base (Latakia) and one major listening station (just outside Latakia). And fourth, it showed the rest of the Middle East that Russia could and would act decisively on the side of the autocratic dynasties across the region.

In a positive for Russia, Syria also has significant oil and gas resources that can be developed and used by the Kremlin to offset part of the costs it incurs as part of its geopolitical manoeuvring. According to Russia’s then-Deputy Prime Minister, Yuri Borisov, in the aftermath of Russia’s intervention in the Syrian conflict in September 2015, Moscow was working to restore at least 40 energy facilities in Syria, including offshore oil fields. This was part of a wider development programme aimed at bringing back the full oil and gas potential of the country as it was before July 2011 when, inspired by the Arab Spring revolutions, defectors from the Syrian army formed the Free Syrian Army and commenced armed conflict across the country. Prior to that point, it has been largely forgotten that Syria was a significant oil and gas producer in the global hydrocarbons markets.

As of the beginning of 2011, Syria was producing around 400,000 barrels per day (bpd) of crude oil from proven reserves of 2.5 billion barrels. Before recovery began to drop off due to a lack of enhanced oil recovery techniques being employed at the major fields – mostly located in the east near the border with Iraq or in the centre of the country, east of the city of Homs – it had been producing nearly 600,000 bpd. For the period when the largest producing fields – including those in the Deir-ez-Zour region, such as the biggest field, Omar – were under the control of ISIS, crude oil and condensates production fell to about 25,000 bpd before recovering again.

It should also be remembered that a sizeable proportion of this crude oil output went to the EU, which was importing at least US$3 billion worth of oil per year from Syria up to the beginning of 2011, according to the European Commission. Much of the key infrastructure to handle oil from Syria remained operationally in place for a long time after the 2011 troubles began. Most of this, some 150,000-bpd combined, went to Germany, Italy and France, from one of Syria’s three Mediterranean export terminals – Banias, Tartus and Latakia.

Syria’s gas sector was at least as vibrant as its oil sector, and less of that was damaged in the first few years of the conflict. With proven reserves of 8.5 trillion cubic feet (tcf) of natural gas, the full year 2010 – the last under normal operating conditions – saw Syria produce just over 316 billion cubic feet per day (bcf/d) of dry natural gas.

The build out of the South-Central Gas Area, built by Russia’s Stroytransgaz, had started up by the end of 2009 and had boosted Syria’s natural gas production by about 40 percent by the beginning of 2011. This allowed Syria’s combined oil and gas exports to generate a quarter of government revenues at that point, and to make it the eastern Mediterranean’s leading oil and gas producer at the time. After the onset of the domestic armed uprising in July 2011 and then ISIS moving west from Iraq into Syria in September 2014, gas production fell off to less than 130 bcf/d before recovering again.

What is occurring therefore is a China-Russia led redevelopment of Shia Crescent energy resources, which will assist in not just powering China, but with the cheap energy development of the entire Middle Eastern region. As Sunni and Shia turn away from conflict and embrace a rather healthier ‘Muslim brotherhood’ peaceful mentality, the balance of regional power within the region has shifted towards guidance and investment from Moscow, and Beijing, instead of the previous attentions paid to it from Washington. A new era is emerging.

Source: Simon Watkins for Oil Price

Related Reading

- China’s 2023 Trade and Investment with Iran: Development Trends

- Russia and Iran – 2023 Bilateral Trade and Investment Dynamic

About Us

Middle East Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Dubai (UAE), China, India, Vietnam, Singapore, Indonesia, Italy, Germany, and USA. We also have partner firms in Malaysia, Bangladesh, the Philippines, Thailand, and Australia.

For support with establishing a business in the Middle East, or for assistance in analyzing and entering markets elsewhere in Asia, please contact us at dubai@dezshira.com or visit us at www.dezshira.com. To subscribe for content products from the Middle East Briefing, please click here.

- Previous Article UAE Trade Relations With East Africa: Current Status & Prospects

- Next Article The UAE Mandatory Unemployment Insurance Scheme