New UAE E-Invoicing System: All You Need to Know

- UAE e-invoicing will roll out in two phases: large firms (AED 50 million+ revenue) must appoint an ASP by July 31, 2026 and go live on January 1, 2027; all other companies must comply by March 31, 2027 and July 1, 2027.

- Technical and reporting rules: B2B/B2G invoices must be issued in XML or JSON and reported to the FTA via an accredited ASP within 14 days.

- ERPs may be hosted abroad, but all e-invoice data processed through the ASP must also be stored on UAE servers, with retention periods of 5 years (VAT), 7 years (CT), and 15 years (real estate).

The UAE is moving toward a fully digital invoicing environment, and many businesses are now preparing the technical and operational requirements that will follow. Our earlier article provided the full framework, legal background, and detailed implementation schedule. You can revisit that overview here: UAE Launches Mandatory E-Invoicing System: What Businesses and Practitioners Need to Know.

The table below briefly recaps the phased timeline before moving into the new updates:

| Phase | Scope | ASP appointment deadline | Mandatory go live |

| Phase 1 | Applies to businesses with annual revenue of at least AED 50 million (US$13.61 million) | July 31, 2026 | January 1, 2027 |

| Phase 2 | Applies to businesses with annual revenue below AED 50 million (US$13.61 million) | March 31, 2027 | July 1, 2027

|

Across both phases, in scope B2B and B2G invoices must be issued in structured XML or JSON format and reported to the FTA through an approved ASP within 14 days.

With the overall structure already established, recent industry sessions have provided additional clarity on two areas where businesses still have open questions: data residency requirements and the practical mechanics of ASP integration. The following sections summarize these updates.

Data residency and retention: Key clarifications

One of the most important updates concerns how long e-invoice data must be kept and where it must be stored. These requirements are now more clearly defined:

- 5 years for VAT related records

- 7 years for Corporate Tax records

- 15 years for Real Estate related records

These periods apply specifically to the digital invoice data and supporting information processed through the e-invoicing system.

Crucially, all such data must be stored within the UAE. This is a physical hosting requirement. Cloud platforms that store data outside the UAE do not meet the obligation. Businesses should verify:

- The physical location of invoice data storage, backups, and archival systems;

- Whether their ASP or internal systems rely on UAE-based servers; and

- How invoice data flows between internal systems and the ASP, and where it is ultimately retained.

For companies using regional or global ERP environments hosted overseas, the requirement does not prohibit foreign hosting of the ERP itself. However, e-invoice data submitted to or received from the ASP must also be retained on UAE-based infrastructure. This may require supplemental storage arrangements or adjustments to existing system architecture.

A point still awaiting further guidance is whether historical invoices from previous financial years will also need to be migrated into UAE-based storage. Many businesses have begun assessing the volume of historical data and what migration might entail should this requirement be confirmed.

These data rules directly influence how companies design their integration approach with the ASP, which is the next area undergoing clarification.

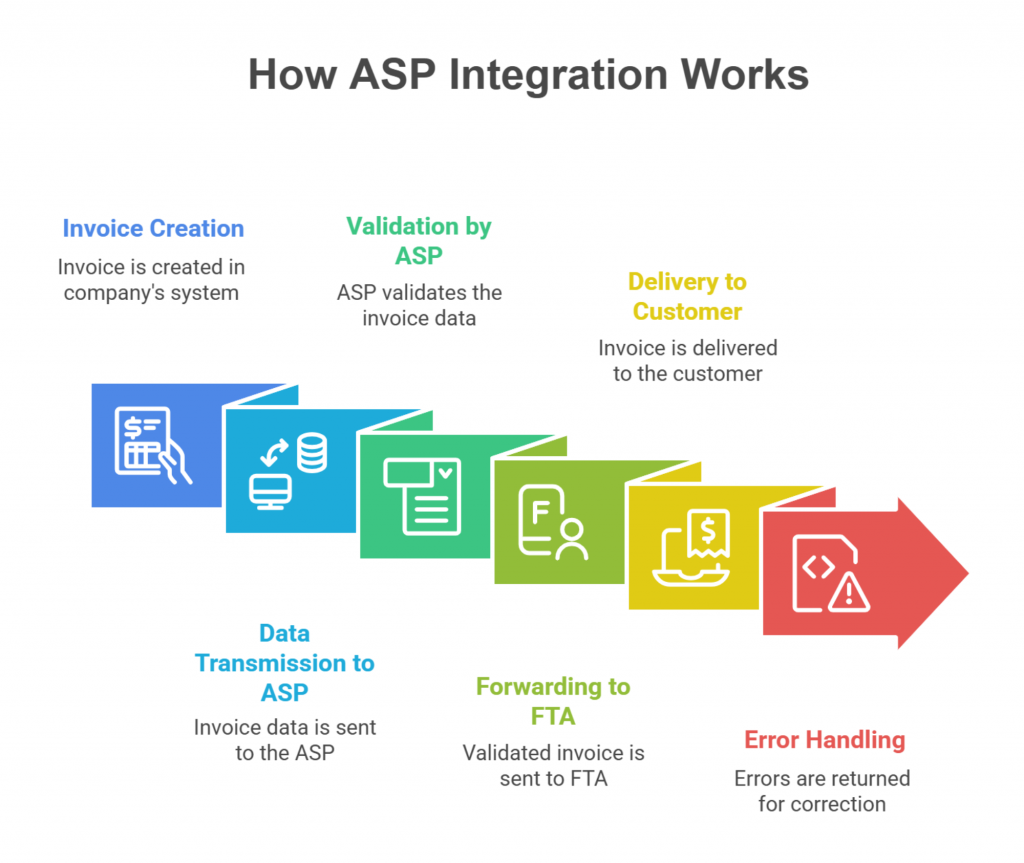

How ASP integration works

The UAE’s e-invoicing model does not replace internal accounting or ERP systems. Instead, the Accredited Service Provider (ASP) serves as the secure bridge between a company’s systems and the national e-invoicing platform. It relies on ASPs to validate and transmit structured invoice data in a standardized and auditable way.

From internal system to ASP to FTA

When a company issues an invoice, the process typically follows these steps:

- The invoice is created in the company’s accounting or ERP system.

- The system transmits the invoice data to the ASP.

- The ASP validates it according to technical and business rules.

- Once validated, the ASP forwards the invoice to:

- The Federal Tax Authority for registration and archiving

- The customer, usually through the customer’s ASP, which then delivers it into their accounting system

If validation fails, the ASP returns structured error messages for correction and resubmission.

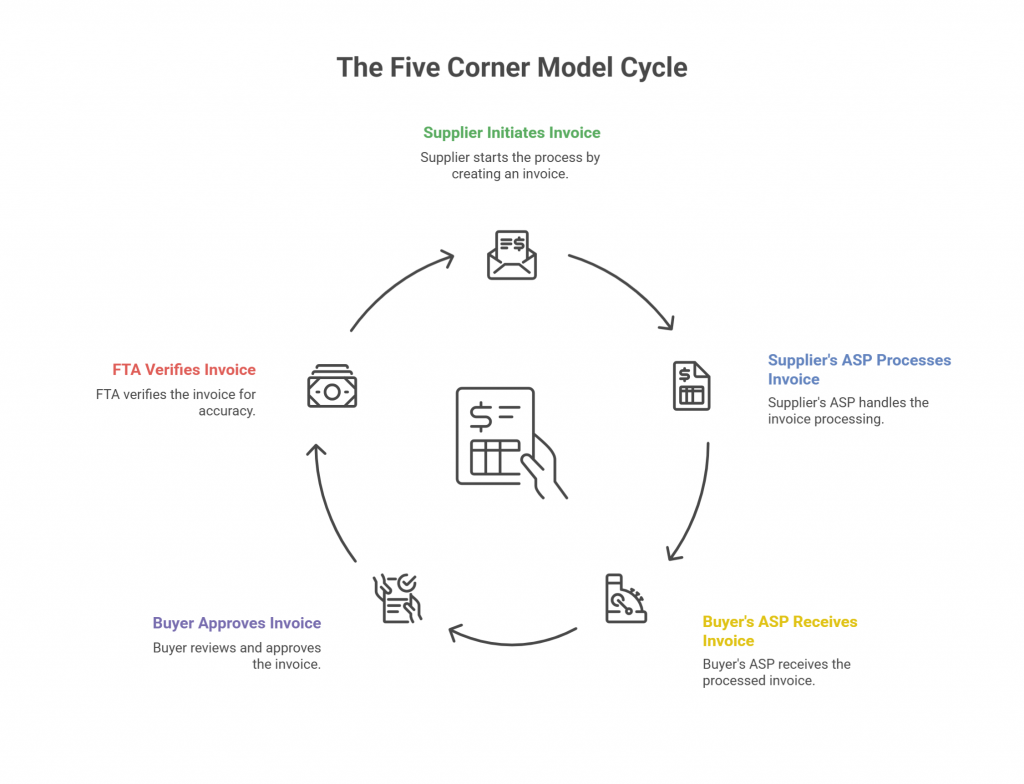

Incoming invoices move through a similar route: they are processed by the supplier’s ASP, passed to the buyer’s ASP, and then delivered into the buyer’s internal accounting system. This creates consistency, reduces manual processing, and ensures both parties receive the same validated document.

The five corner model

This end-to-end flow is organized around five parties:

- Supplier

- Supplier’s ASP

- Buyer’s ASP

- Buyer

- The FTA

Each invoice moves through this network in a controlled sequence, ensuring accurate reporting and traceability at every stage.

One ASP for multiple entities

A practical advantage of the ASP model is that a single ASP environment can support multiple legal entities within the same group, even if each entity uses a different accounting system. This allows:

- One centralized ASP setup

- Multiple connectors for different ERPs or accounting tools

- Group-level oversight of e-invoicing compliance

- Reduced duplication of integration work

This structure is particularly beneficial for multinational companies with several UAE entities or mixed IT landscapes.

Make self-assessment of your company

Recent clarifications point to several areas where early preparation will help avoid last-minute bottlenecks:

- Check your current ERP system: Does your current ERP store the data in the UAE? Is it listed as ASP provider? Do your need to transition to the new ERP with storage of data in the UAE or add another lawyer in addition to existing ERP?

- Confirm data hosting and retention settings: Verify where e-invoice data and backups of your ERP are physically stored and ensure that your setup can meet the 5, 7, and 15 year retention periods in UAE. This includes checking ASP provided storage and any internal or third-party environments used for archiving.

- Design the ASP integration architecture: Define invoices flow between your ERP or accounting systems, the ASP, the FTA, and customers or suppliers. Define how validation errors will be handled, how audit trails will be maintained, and how the five-corner model will operate in your specific system landscape.

- Plan for multi-entity and phased implementation: For groups with more than one UAE entity, assess if the chosen provider supports a single ASP environment that can support all entities in group setups, and what integration approach each system requires. Align this design with the Phase 1 and Phase 2 timelines so that integration and testing can be completed well before each go live date.

As the UAE progresses toward mandatory e-invoicing, clear data stewardship, system readiness, and purposeful integration planning will be critical to a smooth transition. Moreover, mistakes in the filing of VAT invoices will be immediately reflected at the FTA and it will be more difficult to correct the mistakes at FTA. As a result, the demand for high level experts in the tax compliance field will increase.

About Us

Middle East Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Dubai (UAE). Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in China (including the Hong Kong SAR), Indonesia, Singapore, Malaysia, Mongolia, Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to Middle East Briefing’s content products, please click here. For support with establishing a business in the Middle East or for assistance in analyzing and entering markets elsewhere in Asia, please contact us at dubai@dezshira.com or visit us at www.dezshira.com.