Arabic Stock Exchanges Reach Record Highs

The market cap of Arab stock exchanges exceeded US$4 trillion by the end of 2022, according to the Arab Monetary Fund (AMF).

In a press statement released on Friday, (January 6) the AMF said that the market value of the Abu Dhabi Securities Exchange reached US$714.6 billion in the reference year, while that of Dubai Financial Market was valued at US$158.4 billion.

The market value of the Saudi Stock Exchange was US$2.63 trillion; while that of the Qatar Stock Exchange was US$167.09 billion. The market cap of the Boursa Kuwait was US$152.7 billion; while that of the Muscat Stock Exchange was US$61.6 billion.

The Casablanca Stock Exchange market cap was US$53.6 billion; while that of the Egyptian Exchange was US$38.8 billion; and that of the Bahrain Bourse was US$30.2 billion, according to the AMF’s statement.

The market value of the Amman Stock Exchange reached US$25.4 billion; that of Palestine Exchange was US$4.89 billion; while the Beirut Stock Exchange was put at US$14.4 billion, and the Damascus Securities Exchange was valued at US$2.06 billion.

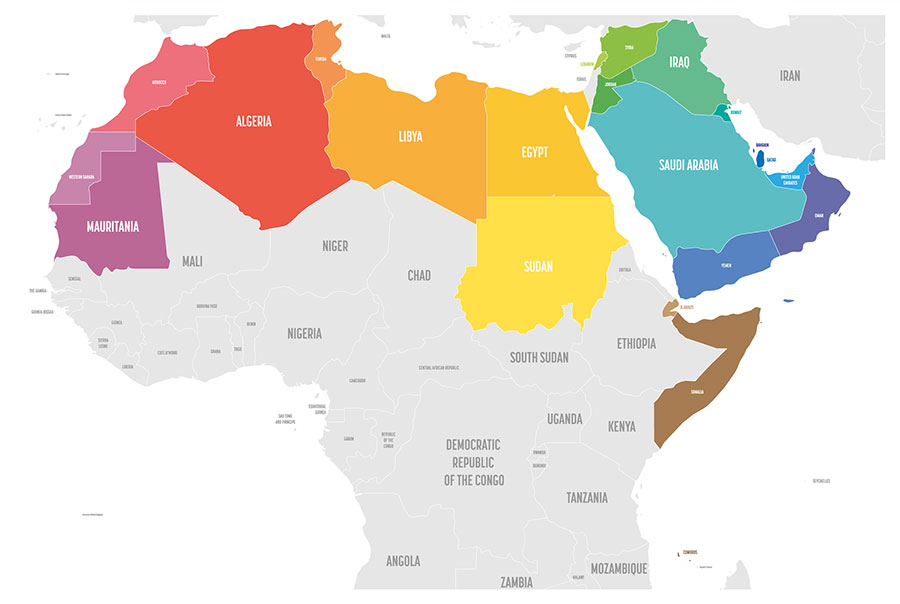

Countries of the Arab League

In numbers:

| Exchange | Value (USD) | |

|---|---|---|

|

Saudi Stock Exchange | 2.63 trillion |

|

Abu Dhabi Securities | 714.6 billion |

|

Qatar Stock Exchange | 167 billion |

|

Dubai Financial Markets | 158.4 billion |

|

Boursa Kuwait | 152.7 billion |

|

Muscat Stock Exchange | 61.6 billion |

|

Casablanca Stock Exchange | 53.6 billion |

|

Egyptian Exchange | 38.8 billion |

| Bahrain Bourse | 30.2 billion | |

|

Amman Stock exchange | 25.4 billion |

|

Beirut Stock Exchange | 14.4 billion |

|

Palestine Exchange | 4.89 billion |

|

Damascus Securities Exchange | 2.06 billion |

Money has been pouring into the Arabic exchanges as peaceful solutions to long-standing rivalries are being brokered by China, as part of its Belt and Road Initiative, and Russia, both of whom want to establish themselves as serious investors in the Arab states and develop energy supply lines.

Last year, China announced a massive energy deal with Saudi Arabia, while Russia is providing infrastructure investments, into the country, including rail. Multiple other infrastructure developments, many related to the Belt and Road, are shifting the Arabic world to the Asian world as opposed to the West in the wake of a continuing rejection of the US ‘unipolar’ political posturing and a desire to better engage with a ‘multipolar’ world order.

Related Reading

- Egypt & Saudi Arabia To Join Shanghai Cooperation Organisation As Dialogue Partners

- China’s Belt & Road Initiative and Qatar

About Us

Middle East Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Dubai (UAE). Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in China (including the Hong Kong SAR), Indonesia, Singapore, Malaysia, Mongolia, Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to Middle East Briefing’s content products, please click here. For support with establishing a business in the Middle East or for assistance in analyzing and entering markets elsewhere in Asia, please contact us at dubai@dezshira.com or visit us at www.dezshira.com.