Abu Dhabi Investment Authority Offers Discounted Buyouts for Investors Exiting China PE

ADIA, the sovereign wealth fund of Abu Dhabi, is strategically positioning itself to benefit from the trend of Western investors reducing their exposure to China.

By Qian Zhou

The Abu Dhabi Investment Authority (ADIA) is strategically positioning itself to benefit from the recent trend of western investors reducing their exposure to China. ADIA aims to achieve this by offering to acquire discounted stakes in funds managed by Hong Kong-based PAG, as reported by the Financial Times.

The move orchestrated by Abu Dhabi’s primary sovereign wealth fund reflects a broader pattern – Gulf investors actively seeking investment opportunities while counterparts with Western market exposure or HQ scale back their investments in the Chinese market. In a landscape of shifting dynamics, ADIA’s calculated approach underscores the allure of value-driven acquisitions in the ever-evolving global investment arena.

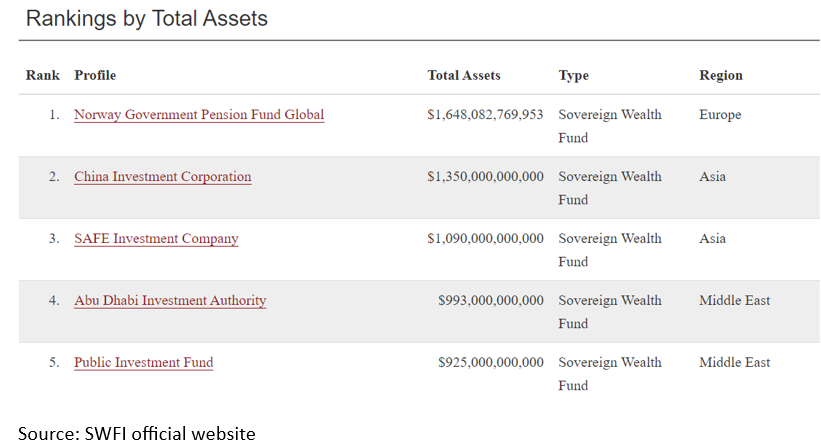

ADIA is the world’s fourth largest sovereignty wealth fund as of March 2024, managing total assets of US$99.3 billion. PAG, in which Blackstone holds a minority stake, is an alternative investment firm that has gained recognition for providing international investors with opportunities to participate in Chinese deals. It currently manages approximately US$55 billion in multiple asset classes, primarily engaging in private credit, PE investments, and real estate investments.

Top 5 Sovereignty Wealth Funds by Total Assets

Background

In recent years, following a downturn in the IPO market, many US dollar funds invested in China are facing challenges due to project exits and end-of-term liquidation.

Currently, US dollar fund managers (GPs) primarily attempt to persuade limited partners (LPs) to extend the fund’s duration. However, this approach may impact LPs’ willingness to make subsequent investments in US dollar funds. Given this, more and more large US dollar funds have started to seek Middle East capital to take over.

“For large US dollar funds, Middle Eastern capital has consistently been an ideal successor”, a senior executive at a major Chinese private equity (PE) firm said.

The reasons behind this trend are multifaceted. Firstly, large scale US dollar funds often manage substantial assets, and the project amounts left unexited upon fund maturity can easily exceed US$1 billion. Consequently, significant capital is required for successful succession. Besides, Middle Eastern capital shows a keen interest in continuing investments in high-quality projects within the portfolios of large PE funds. As Europe and the United States grapple with higher interest rates and economic growth slowdowns, the ability of large LPs in these regions to continue investing is diminishing. In contrast, Middle Eastern capital finds itself presented with favorable opportunities. Furthermore, fluctuations in U.S.-China relations have led European and American LPs to reduce their willingness to continue investing in US dollar funds focused on China. In comparison, Middle Eastern capital does not share these concerns.

The involvement of Middle Eastern funds in taking over expiring shares of US dollar funds could inject new vitality into the Chinese PE market. If these transactions proceed successfully, they may pave the way for innovative approaches for handling fund liquidation and maintaining positive relationships between fund managers and investors. This will enhance the stability of China’s PE market.

However, the success of this transaction largely depends on the quality of investment projects within PAG’s US dollar fund. If these investment projects generally have promising prospects and sustainable performance growth, PAG might even achieve a premium exit through the transaction. Conversely, if the projects do not meet these criteria, PAG may need to offer significant discounts to facilitate the deal. In addition, setting up the transaction structure for transferring large US dollar fund shares may indeed be challenging. This involves addressing several key issues, including regulatory approval, tax planning, and convenience of share transfer and fund payment, etc.

ADIA’s Increasing investment in China

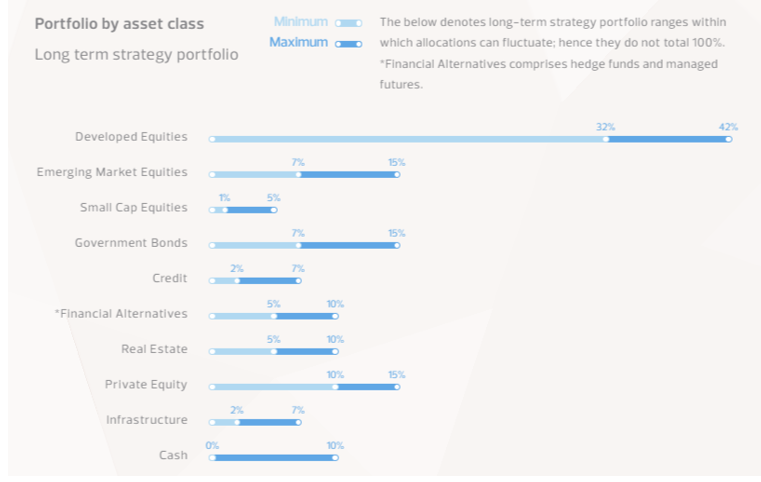

In recent years, Middle Eastern investors have been actively seeking opportunities in China. Take the ADIA as an example: despite allocating over 60 percent of its assets to Europe and the United States, it has also increased its investments in emerging markets, including China, to 10 -20 percent. This shift indicates that Middle Eastern capital, which has traditionally focused on Europe and the US, is now redirecting its investment attention toward the Chinese market.

|

ADIA’s Long-Term Portfolio by Region |

||

| Region | Minimum | Maximum |

| North America | 45% | 60% |

| Europe | 15% | 30% |

| Developed Asia | 5% | 10% |

| Emerging Markets | 10% | 20% |

Source: ADIA official website

Since 2020, the ADIA has notably shown a stronger preference for China assets. According to a research report by CITIC Securities titled “What Is Middle Eastern Capital Buying?” in May 2023, the Chinese mainland’s share in ADIA’s portfolio increased from 4.5 percent at the end of 2019 to 22.9 percent in the first quarter of 2023. Furthermore, the Chinese mainland’s ranking within ADIA’s portfolio rose from fifth at the end of 2019 to third in the first quarter of 2023.

As of the end of the second quarter in 2023, ADIA appeared among the top 10 public shareholders of 26 A-share listed companies in China. Their total shareholding amounts to 479.62 million shares, with a combined market value of RMB7.74 billion. In addition to stocks, ADIA’s asset allocation in China includes PE, bonds, and infrastructure development related to unicorn companies. Their investments in the PE sector encompass both local and regional funds, while they also explore opportunities for joint investments with other funds in small and emerging enterprises.

ADIA Investment Portfolio by Asset Class

Source: ADIA official website

The speed of innovative development and the strength of policy support in China are both aspects that the ADIA views favorably. According to Khalid Al-Falih, the Saudi Minister of Investment, the relationship between Saudi Arabia and China is shifting from a mere trade relationship to a core investment relationship.

About Us

Middle East Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Dubai (UAE), China, India, Vietnam, Singapore, Indonesia, Italy, Germany, and USA. We also have partner firms in Malaysia, Bangladesh, the Philippines, Thailand, and Australia.

For support with establishing a business in the Middle East, or for assistance in analyzing and entering markets elsewhere in Asia, please contact us at dubai@dezshira.com or visit us at www.dezshira.com. To subscribe for content products from the Middle East Briefing, please click here.

- Previous Article Dubai’s New Tax Regulation for the Banking Sector

- Next Article Saudi Arabia’s US$40 Billion AI Fund: Outlook and Opportunities