GCC Countries 2024 Economic Outlook and Growth Trends

In 2024, the GCC anticipates robust economic growth, led by the UAE and Saudi Arabia, with the World Bank highlighting positive trends and the rebound from slower 2023 performance.

By Giulia Interesse

In 2024, the Gulf Cooperation Council (GCC) region anticipates significant economic growth and business expansion. The World Bank’s Global Economic Prospects Report (hereinafter, “the World Bank’s report”) notes a projected rebound in GCC economic growth this year, following a slower performance in 2023. This deceleration was primarily attributed to reduced activity in the oil sector, influenced by OPEC+ production cuts. Nevertheless, the decrease in oil sector activities is expected to be offset by the non-oil sectors, projected to maintain a steady expansion of 3.4 percent in the medium term.

This positive trend is supported by ongoing private spending, targeted investments in key areas, and a flexible fiscal policy.

In this article, we explore the economic trajectories guiding the GCC’s growth in 2024.

UAE and Saudi Arabia lead regional growth

As per the World Bank’s report, the GCC region is expected to experience overall growth of 3.6 percent in 2024, followed by a further increase to 3.8 percent in 2025. This optimistic projection is credited to the strong performance of the non-oil sectors over the past two years. It is also important to note that the report recognizes challenges faced by the Middle East and North Africa (MENA) region in 2023, which included factors such as oil production cuts, increased inflation, and sluggish activity in the private sector of oil-importing economies.

Projections indicate that the UAE’s GDP witnessed a 3.7 percent expansion 2023, and anticipate an accelerated growth of 3.8 percent in 2024. Simultaneously, Saudi Arabia is anticipated to experience a growth rate of 4.1 percent, with a further increase to 4.2 percent.

As per the individual GCC countries’ estimated GDP growth:

- Saudi Arabia: Expected to achieve a growth rate of 4.1 percent in 2024, with a further increase to 4.2 percent projected in 2025.

- UAE: Anticipated to witness real GDP growth of 3.7 percent in 2024 and a subsequent rise to 3.8 percent in 2025.

- Bahrain: Forecasted to experience growth of 3.3 percent in 2024 and 3.2 percent in 2025.

- Oman: Estimated to undergo growth of 2.7 percent in 2024, with a further increase to 2.9 percent in 2025.

- Kuwait: Projected to achieve a growth rate of 2.6 percent in 2024 and an increase to 2.7 percent in 2025.

- Qatar: Anticipated to grow by 2.5 percent in 2024, with a projected further increase to 3.1 percent in 2025.

Trends to watch: Key diversification sectors

Saudi Arabia: An emerging tourist destination

In recent years, the tourism sector in Saudi Arabia has experienced solid growth, solidifying the country’s status as a prominent and sought-after destination. Fueled by the goals outlined in the national Vision 2030, the kingdom is proactively seeking to emerge as one of the top global tourist hotspots.

In October 2023, the Minister of Tourism, Ahmed bin Aqeel Al-Khateeb, emphasized that Saudi Arabia stands out as the fastest-growing nation among the G20 countries in the tourism sector, with a tourist influx surpassing 30 million. This figure represents a significant 40 percent of the targeted tourist number, highlighting the pivotal role of the sector in fostering economic growth. The goal is to increase its share of the national GDP from 3 percent in 2019 to an ambitious 10 percent by 2030, attracting 150 million local and international tourists (this target was just recently revised, up from the previous 100 million, in light of current positive trends).

To achieve this goal, the Ministry of Tourism has already committed to a substantial 10-year, US$1 trillion investment plan dedicated to the tourism sector, with the goal of expanding hotel capacity by 310,000 rooms by 2030. Strategic investments in tourism-related infrastructure, encompassing airports, hotels, and transportation, have already significantly enhanced the overall tourist experience and accessibility in the kingdom.

Streamlined visa processes further facilitate entry for potential visitors, contributing to the nation’s allure as an attractive destination. At the beginning of January 2024, Saudi Arabia launched the KSA Visa, an integrated national visa application platform connecting more than 30 ministries, authorities, and private-sector entities. The goal is specifically to ease the visa application process for various purposes, including:

- Hajj;

- Umrah;

- Tourism;

- Business visits; and

- Employment.

Moreover, in alignment with its comprehensive strategy aimed at attracting investment and boosting tourist spending, Saudi Arabia is hosting several events in 2024, including the Formula 1 Saudi Arabia Grand Prix in Jeddah and various conferences and summits. Named as the host for the 2030 Expo in Riyadh, the kingdom is also poised to secure its position as the host nation for the 2034 World Cup, with FIFA likely to confirm this in the coming year.

These concerted efforts have already yielded positive results for the country’s tourism industry. The UN’s World Tourism Organization reports that Saudi Arabia emerged as the second-fastest growing tourism destination globally, based on international tourist arrivals in the first quarter of 2023.

These trends not only signify a transformative period for Saudi Arabia’s tourism landscape, but also contribute to the overall growth trends observed across GCC countries in 2024.

Energy transition

In 2023, the GCC played a crucial role in the global energy landscape, navigating the complex interplay between the transition to renewable energy and the world’s continued dependence on traditional hydrocarbons. Unforeseen events, including economic slowdowns, deviated from initial projections, impacting the oil-dependent economies in the region.

As the energy sector in the region looks ahead to 2024, it confronts challenges related to climate change and diversification while also seizing opportunities for technological advancement, international collaboration, economic diversification, and the expansion of renewable energy.

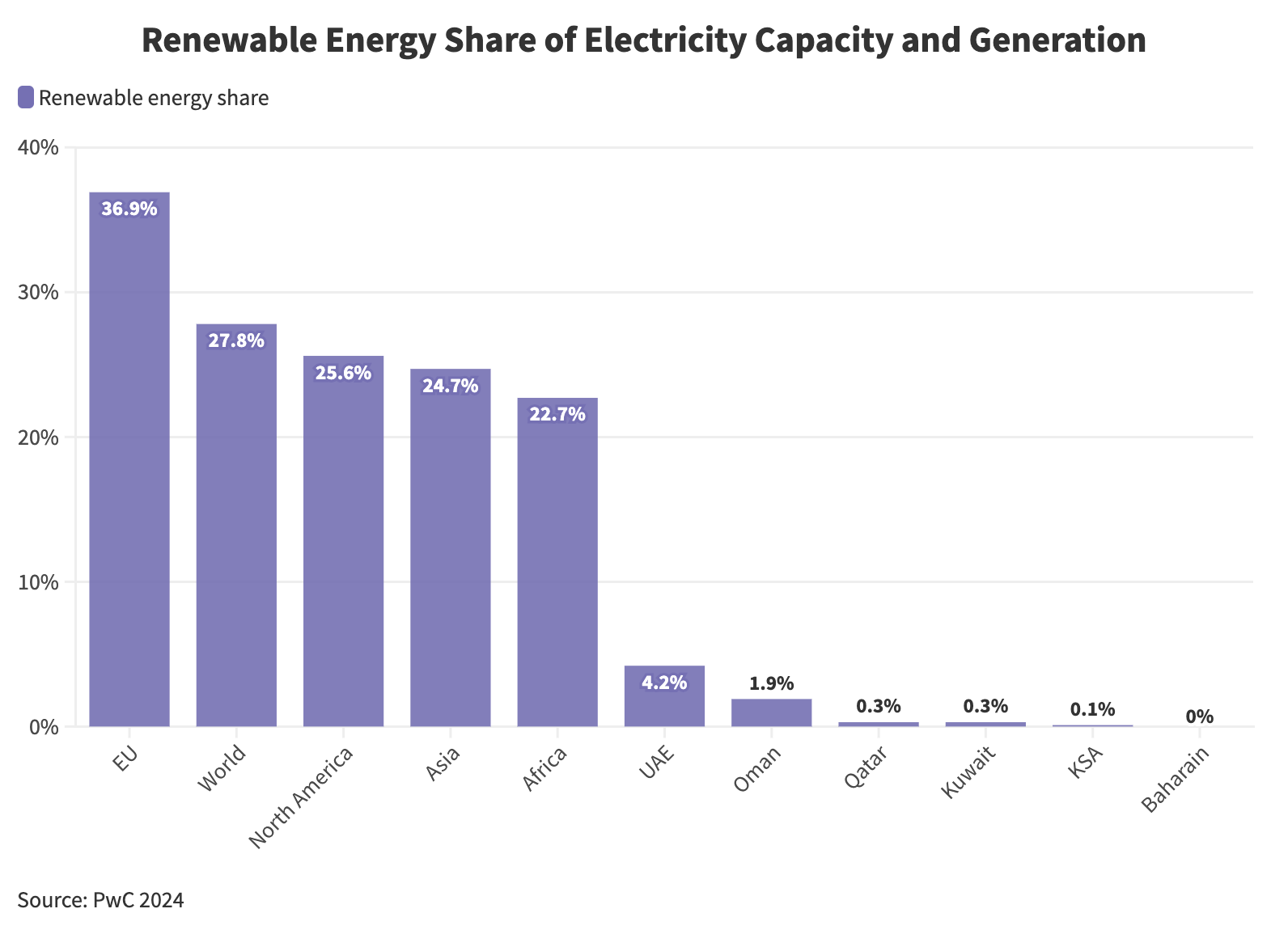

Currently, renewable energy constitutes a mere 3 percent of the total power output in the GCC. The UAE takes the lead within the GCC, with approximately 14 percent of its energy generation derived from renewables, representing a significant 60 percent of the region’s overall renewables capacity. In contrast, Saudi Arabia produces less than 1 percent of its total power output from renewable sources, underscoring the need for intensified efforts to align with its decarbonization objectives.

Nevertheless, the ongoing energy transition, marked by the widespread deployment of renewable energy, offers the region significant opportunities for both climate change mitigation and adaptation, as well as economic diversification. Given the high climate vulnerability in the area, there is a sense of urgency for actions in climate mitigation and adaptation, with renewables emerging as crucial contributors to these efforts.

In 2022, the outflow of FDI from the UAE amounted to a contribution of approximately US$36 billion (AED 132.5 billion) directed towards renewable energy projects, a trend that is anticipated to persist. Looking ahead, the federation has planned to finance the development of two solar and one wind power plants in Azerbaijan between 2024 and 2027.

Similarly, Qatar is seeking to double its renewable capacity by the end of 2024, a commitment that involves expanding solar capacity to 1.6GW through the completion of two new projects. This objective serves as a crucial steppingstone toward the country’s ambition of achieving 2GW to 4GW of installed renewables by the year 2030.

Meanwhile, Oman unveiled a sustainable finance framework aimed at reduce the country’s reliance on fossil fuels, while attracting environmental, social and governance (ESG) investors.

The GCC boasts a robust energy infrastructure that can serve as a foundation for the increased integration of renewables. Anticipated investments in renewables within the GCC are poised to reach unprecedented levels in the aftermath of COP28. While the region’s historical narrative has been predominantly shaped by fossil fuels, there is a notable shift on the horizon, with renewables poised to play a pivotal role in defining its future energy landscape.

Conclusion

In 2024, the GCC region anticipates a positive economic outlook with a recovery from the slowdown in 2023. Key factors contributing to this optimism include the reversal of oil production cuts, strong international oil prices, and growth in the non-oil economy. The moderation of inflation, central banks easing monetary policy, and sustained growth in the tourism sector, especially in Saudi Arabia, are expected to further support the region’s economic recovery.

In terms of sustainability, the GCC countries are actively diversifying their economies, focusing on human capital development, and aligning with sustainability goals. The shift towards clean energy, exemplified by the UAE’s investments in solar energy and Saudi Arabia’s emphasis on tourism and entertainment sectors, demonstrates a commitment to diversification.