Japan’s Multilateral Trade with the GCC; 2023 / 2024 Status and Prospects

By Farzad Ramezani Bonesh

Japan’s foreign policy goals and priorities are mentioned in the country’s constitution, with measures and approaches such as the approval of the National Security Strategy (NSS) and National Defense Program Guidelines (NDPG). Japan is ready to play a greater role in the GCC, strengthen diplomatic missions, preserve, and promote Japan’s national interests, and increase its global presence.

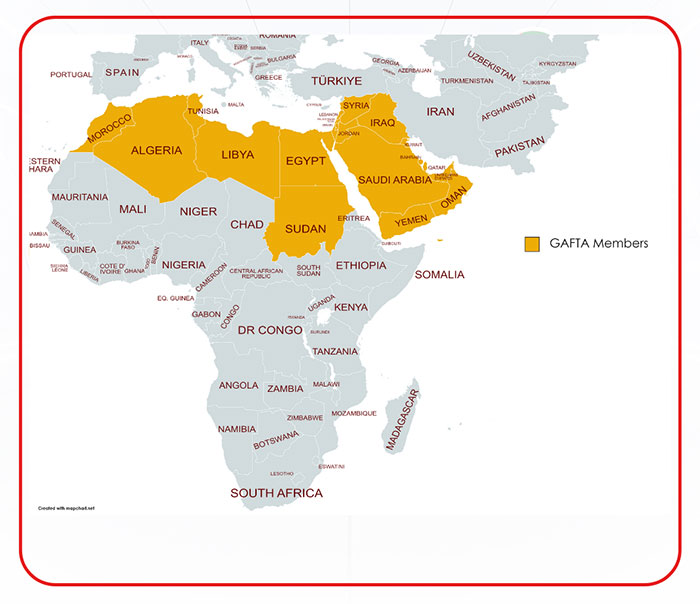

The Gulf Cooperation Council (GCC) includes Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE. All are additionally members of the Greater Arab Free Trade Area (GAFTA), which also includes GAFTA are: Algeria, Egypt, Iraq, Lebanon, Libya, Morocco, Palestine, Sudan, Syria, Tunisia, and Yemen. The GCC represents the most economically powerful of the GAFTA nations.

Japan-GCC Overview

The GCC hopes that Japan will provide more assistance in ensuring stability in the region and strengthening economic relations, development, and investment. Considering Japan’s vision of a “free and open Indo-Pacific region”, the country is considered an important partner and friend, a priority relationships, and as having great influence in the regional and international arenas.

Apart from the agreement in regular meetings between Japan and the GCC, formulating the “Japan-GCC Action Plan 2024-2028” is an important step in developing these institutional relations.

The ministerial meeting of the GCC and Japan in September 2023, in Riyadh, saw talks on strengthening relations. From Japan’s point of view, the GCC countries are also increasing their role in the international arena, including in politics and economics, and Japan is looking for ways to improve these relationships.

Japan sees an important part of its goals with the GCC from the perspective of geo-economics and economics; and is facing increasing dependence on GCC energy. The country is one of the largest importers of liquefied natural gas, petroleum products, and crude oil in the world. Tokyo hopes that the GCC will continue to stabilize the global crude oil market.

The development of alternative energy sources such as hydrogen, diversification of energy sources, security and stability of the energy market, and complete security of energy transmission routes from GCC are all strategically important for Japan.

Japan has tried to strengthen its relations with the countries of the GCC in a wide range of fields, such as various aid mechanisms, supporting infrastructure and economic stabilization, achieving economic reforms and so on. Just as the GCC seeks to reduce its dependence on oil and diversify its economy, it also expects Japan to provide technological cooperation to allow it to do so.

Japan wishes to strengthen free and open global economic systems, support the expansion of trade and investment of Japanese companies, penetrate the regional GCC market, and compete with other players – such as China – in the Middle East.

The GCC region is also the second largest customer of Japan’s auto exports and an importer of numerous Japanese construction and mining equipment and beverages. Helping to attract foreign capital and develop an export-oriented view in relations with GCC (with complementary economies) is under consideration by both sides.

Tokyo is also eager to transfer GCC investment from China to Japan. Both are looking for other trade and knowledge exchange areas, such as food exports from Japan, nuclear and even space technology, education, science, technology, health, tourism, finance, culture, and sports.

In food security, Kuwait-based Gulf Investment Company (GIC) established a food fund in cooperation with Japanese banks to support food and agriculture trade and food security.

More recently, during the meeting of the GCC Secretary General and Japanese Prime Minister in Jeddah in July 2023, the GCC and Japan signed an agreement to resume negotiations on the free trade agreement. The Free Trade Agreement proposal provides valuable foundations for expanding trade and investment and achieving greater cooperation between the two sides. It helps customs procedures, dispute resolution, and trade in goods and services.

Trade between Japan and the GCC in 2021 was about US$80 billion, with Saudi Arabia and the UAE accounting for about 80% of the total. Japan was the fourth largest GCC import and export market in 2023. Exports from the GCC to Japan are worth US$76.7 billion, while exports by Japan to the GCC to Japan are worth US$22 billion.

Japan – Bahrain Trade & Investment

Diplomatic relations between Tokyo and Manama were established for the first time in 1972, with Japan subsequently becoming one of Bahrain’s main trading partners. Several official visits and high-level meetings over the past decade have helped boost bilateral relations.

In addition to Japan’s large aid contributions and technical cooperation with Bahrain, thirteen trade agreements were signed in March 2013. Japanese companies are active in Bahrain, but current Japanese FDI in Bahrain is limited. The signing of a MoU to promote direct investment in December 2021, and the signing of an investment agreement in June 2022 will help highlight Bahrain as an investment destination for Japanese companies and strengthen economic ties between the two countries.

There is also the possibility of further cooperation in sectors such as financial services, industry, telecommunications, information technology, and the digital economy.

In 2021, Japan exported US$510 million of goods to Bahrain, while the same year, Bahrain exported US$1.04 billion to Japan.

Japan’s imports from Bahrain were US$1.33 billion in 2022. The main products that Japan imports from Bahrain are mineral fuels, oils, distillation products, aluminium, copper, fish, crustaceans, molluscs, aquatic invertebrates, inorganic chemicals, precious metal compound, isotope, glass and glassware, and textiles.

Japan’s exports to Bahrain were US$459.73 million in 2022, with the main products that Japan exported being autos, machinery, nuclear reactors, boilers, pearls, precious stones, metals, rubbers, electrical and electronic equipment, stone, plaster, cement, asbestos, mica, and similar materials, optical, photo, technical, medical apparatus, articles of iron or steel, and plastics.

Japan – Kuwait Trade & Investment

The energy sector is at the forefront of trade relations between the two countries, with Kuwait being one of the largest suppliers of oil to Japan.

Also, Japan and Kuwait are discussing ammonia production, transportation methods, and modern technologies for future fuels, while also planning to achieve zero carbon emissions. Tokyo and Kuwait City are increasing their energy security, and a transition to new energy sources.

Japanese companies operate in various fields in Kuwait, especially in infrastructure. Increasing bilateral cooperation in the development of electricity and water infrastructure are also being discussed. In 2021, Japan exported US$1.61 billion of goods to Kuwait, while Kuwait exported US$5.79 billion to Japan.

The main products that Kuwait exported to Japan are crude and refined petroleum, and petroleum gas. The main products that Japan exported to Kuwait were autos, iron pipes, and delivery trucks.

Japan – Oman Trade & Investment

Since the formal establishment of diplomatic relations between Tokyo and Muscat in May 1972, Japan and Oman have enjoyed friendly relations for decades.

Japan’s major imports from Oman are dominated by crude oil and natural gas (LNG). Oman, possessing a stable supply of oil and gas, and Japan with financing and technology have cooperated on multiple projects.

Oman LNG signed three natural gas supply agreements worth 2.35 million tons in December 2022 with Japanese companies. Oman will deliver gas from 2025. New fields such as new energy, green hydrogen, and ammonia are also being discussed, as is Japanese participation in the Oman Vision 2040 national initiative.

While only a small number of Japanese companies operate in Oman, they have participated in several large industrial projects in Oman, including projects related to oil and gas, LNG and transportation, and the Sohar Industrial Zone. By increasing the level of cooperation and participation to new levels in various economic fields, it is expected that Japan will participate more in the fields of economic diversification, technology transfer, human resource development, and the Duqm industrial zone project.

Japan imports from Oman reached USS$3.15 billion in 2022, with the main products being mineral fuels, oils, distillation products, salt, sulfur, earth, stone, plaster, lime, and cement, food waste, animal fodder, aluminium, organic chemicals, fish, crustaceans, molluscs, aquatics invertebrates, and tubers, ore slag and ash, pearls, precious stones, and metals.

Japan’s exports to Oman were worth US$1.21 billion in 2022, with these comprising mainly autos, iron and steel, machinery, nuclear reactors, boilers, electrical and electronic equipment, rubber, optical, photo, technical, medical apparatus, stone, plaster, cement, asbestos, mica and similar materials, plastics, ores slag, and ash.

Japan – Qatar Trade & Investment

>

>

Diplomatic relations between Tokyo and Doha were established in 1971. The LNG import agreement in 1996, the signing of the economic agreement in April 2006, the establishment of the Joint Economic Committee, the visit of the Japanese Prime Minister to Qatar in August 2013, and the Qatar-Japan Business Forum in August 2013 have all been part of the development of relations.

More recently, a joint declaration on the establishment of a strategic dialogue mechanism, the visit of the emir of Qatar to Tokyo in September 2022, the visit of the Japanese prime minister to Qatar in July 2023, and the expansion of relations to investment, science, technology, and tourism, are all in line with enhancing relations to a strategic partnership.

Tokyo is the largest buyer of LNG in the world and became Qatar’s first LNG customer in the late 1990s, playing a key role in the development of Qatar’s (LNG) industry. New LNG contracts are less certain, but coordination with Qatar is important to stabilizing global liquefied natural gas markets.

Also, new electricity production businesses such as renewable energy, hydrogen energy production, and ammonia energy are areas for relations.

As of 2021, there were 34 Japanese companies in Qatar, and they were extensively engaged in the construction of infrastructure projects to prepare for the 2022 World Cup, and other critical infrastructure projects in Qatar such as the Doha Metro, International Airport, LNG development, and solar power plants.

Cooperation between the two countries has also expanded beyond energy and infrastructure projects to joint investment in other countries, the production of new types of clean energy, the human genome project, the LNG Golden Pass project, satellite projects, and growing vegetables without soil.

Qatar exports to Japan reached US$12.57 billion in 2022, with the main products that Qatar exported being mineral fuels, oils, and distillation products, aluminium, inorganic chemicals, precious metal compounds, isotopes, salt, sulfur, earth, stone, plaster, lime and cement, plastics, optical, photo, technical, medical apparatus, machinery, and boilers.

Japan’s exports to Qatar were US$1.25 billion in 2022, with the main products that exported to Qatar being automotive, machinery, boilers, iron and steel bars, rubber, electrical and electronic equipment, optical, photo, technical, medical apparatus, stone, plaster, cement, asbestos, manmade fibers, and plastics.

Japan – Saudi Arabia Trade & Investment

Historical relations between Tokyo and Riyadh date back to the late 1930s. In 1955, the two countries officially established diplomatic relations.

The signing of an agreement on economic and technical cooperation between the two countries in 1975, a bilateral agreement to open the market for goods and services, strategic agreements in 2019, the Saudi-Japan Business Council, the March 2017 visit of King Salman bin Abdulaziz from Japan, and the visit of the Japanese Prime Minister to Saudi Arabia have all helped develop trade relations.

In December 2022, the fifth Saudi Arabia-Japan Vision 2030 Business Summit took place in Riyadh, with a MoU concluded between the two countries in various fields.

During a bilateral meeting in Riyadh in 2023, the two countries leaders expressed their commitment to deepen economic cooperation and strengthen cooperation, signing 26 economic agreements. With the formation of the joint economic committee, regular discussions have been facilitated and it has played a central role in identifying cooperation, solving challenges, and evaluating the progress of projects.

Saudi Arabia is the main supplier of Japan’s oil, with nearly 40% of Japan’s oil needs are imported from the country. The two countries have increased cooperation in the energy sector, ensuring energy security, and exploring ways to diversify energy partnerships, energy transition with a focus on electricity, renewable energy, energy efficiency and innovation, promotion of innovation, and technology transfer.

Japan seeks to develop joint projects related to the safe use of hydrogen and ammonia technologies. Therefore, they signed a cooperation agreement in the field of the development of ammonia and hydrogen and, reviewing the supply chain of hydrogen and ammonia.

In addition, Saudi Arabia is planning to deploy nuclear power, large reactors, and small, more advanced technology; and Japan has negotiated with the country in this regard.

Saudi Arabia plans to make US$3.3 trillion in joint investments with Japan by 2030. Nearly 100 Japanese companies are investing. With the help of Japan, Saudi Arabia wants to produce 500,000 electric cars annually.

While Tokyo seeks to reduce its dependence on countries such as China for key minerals, cooperation, and joint ventures for the development of rare earth resources with Saudi Arabia are on its agenda.

Digital advancements are aligned with Japan’s expertise in logistics technology and this creates opportunities for startups in the entertainment, logistics, and tourism sectors. Riyadh’s ambitious economic reforms with Japan’s technological capabilities create new opportunities. Increased cooperation has made Japan the third-largest trading partner of Saudi Arabia.

Japanese exports to Saudi Arabia reached US$5.08 billion in 2022. The main products that Japan exported to Saudi Arabia were automotive, trams, machinery, nuclear reactors, boilers, rubber, iron and steel bars, electrical and electronic equipment.

Japan imported US$42.35 billion of goods from Saudi Arabia during 2022, including mineral fuels, oils, distillation products, aluminium, organic chemicals, copper, plastics, ores slag and ash, fertilizers, pearls, precious stones, metals, electrical and electronic equipment, and miscellaneous chemical products.

Japan – United Arab Emirates Trade & Investment

Japan recognized the UAE as an independent country in December 1971. Avoiding double taxation on income in December 2004, the Statement 2013 on Enhancing Comprehensive Cooperation, Cooperation on the Peaceful Uses of Nuclear Energy July 2014, the Abu Dhabi-Japan Economic Council (ADJEC), Cooperation on the Joint Credit Mechanism (JCM) in Japan in April 2023, and participation in innovation have all been part of the process in developing economic relations.

In July 2023, Tokyo and Abu Dhabi signed 23 agreements and MoU aimed at strengthening economic, commercial, and investment relations in the fields of trade, investment, energy, renewable energy, industry, advanced technology, artificial intelligence, space, health, transportation, transport, transport, and environment.

The UAE is one of Japan’s largest suppliers of crude oil, and the economic relations cover various sectors including renewable energy, and significant projects for hydrogen production and energy.

In this regard, the signing of the joint statement, the consolidation of their participation in green energy, the agreement, the signing of large projects for hydrogen production and its use, and the support of energy transfer are significant.

More than 350 Japanese companies, employing over 4,000 Japanese nationals are based in the UAE. UAE investment in Japan (40% of FDI inflows to Japan from the MENA region) reached US$1.2 billion at the end of 2022.

Japan is among the top five sources of foreign direct investment in the UAE with US$14 billion and 10,000 Japanese companies or agencies in various sectors.

To secure significant investment in the Japanese semiconductor industry, the government plans to support the growth of Japanese companies by tapping into the vast financial resources of the UAE. The two countries have agreed to strengthen cooperation in semiconductor development and manufacturing.

The preliminary agreement for the establishment of the UAE-Japan Business Council, the promotion of relations between the private sectors, cooperation in new economic sectors, cooperation in advanced technology, artificial intelligence, the discovery and diversification of relations in sustainable projects, and the sector of innovation production could lead to a comprehensive strengthening of the strategic partnership of the two countries.

The two sides’ economic cooperation is also expanding to many different fields such as aviation, tourism, space, culture, education, medical services, and environment. Japanese tourist visitors to the UAE reached 56,000 in 2022.

The UAE is Japan’s seventh-largest trading partner, while Japan is the UAE’s eighth-largest trading partner. The UAE is Japan’s largest trading partner in the Arab world.

Total trade between the two countries reached US$51.7 billion in 2022, while non-oil trade grew by 10% over 2021. In H1 2023, the two countries’ non-oil trade increased by 4.2% indicating a developing trend.

Japan’s exports to the UAE reached US$8.48 billion in 2022, The main products that Japan exported to the UAE were autos, trams, machinery, nuclear reactors, boilers, iron and steel, electrical and electronic equipment, rubber, optical, photo, technical, and medical apparatus.

Japanese imports from the UAE reached US$45.8 billion during 2022, with the main products being mineral fuels, oils, distillation products, aluminium, pearls, precious stones,copper, plastics, machinery, and boilers.

The Japan – GCC Vision

From the point of view of many businesses in Japan, the GCC countries sometimes impose restrictions on foreign capital in certain sectors, and sometimes their tax systems and requests change suddenly. This is viewed as an obstacle. Should Japan’s competitors conclude a Free Trae Agreements with the GCC, it will be a more difficult competitive environment for Japanese companies. The expansion of China’s comprehensive presence and influence in the GCC, tensions and the security situation in the region, the possibility of competing with Japan’s interests are among the challenges to strengthening Japan’s relations with the GCC.

However, the absence of historical and severe differences or enmity between Japan and GCC countries, the absence of colonial past in the region, financial and human capabilities, and suitable brands of Japanese companies are important platforms for expanding relations in the future.

Japan has capabilities and advanced technology that enable it to establish a long-term strategic partnership with the GCC, which can also benefit from Japan’s support for its vital geo-economics and economics, strengthen its balance, and establish strategic relations.

Variables such as the attractive market and large energy reserves of the GCC and the activation of the FTA are important platforms for the expansion of relations in the future.

About Us

Dezan Shira & Associates assists foreign investors into Asia and has an office in Dubai. We also have partner firms in Japan as well as within the GCC nations. For assistance, please contact us at asia@dezshira.com, and view our business advisories below.