Turkiye And India Trade and Investment Summary 2022 YTD

Significant Middle-Class Consumer Markets And Developing Infrastructure Will See The Turkiye-India Trade Corridor Develop Rapidly Into 2023-24

By Constantin Duhamel

Introduction

Centuries-Old Bilateral Relations.

The Ottoman Empire and the Indian subcontinent established formal diplomatic relations in 1481 and were exposed to the same cultural influences under Mughal (a Turkic elite) rule of India, which lasted formally until 1857. The Indian and Turkish nation-states have a rich history of cooperation and understanding from which to draw from as they turn their sights to defending their interests in a less unipolar world.

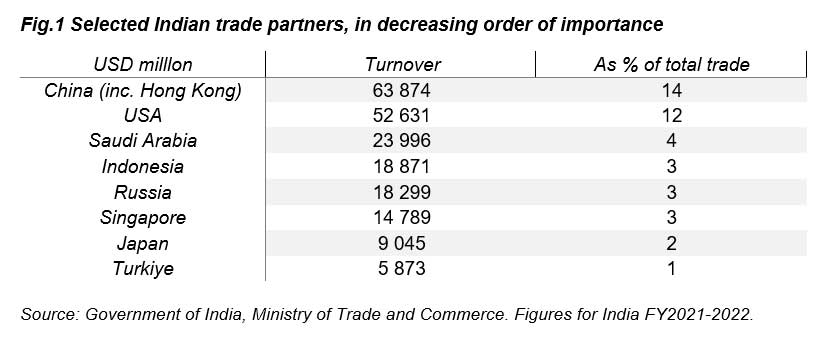

China Tops Trading Partner Rankings.

Contrary to market orthodoxy that would have the US as India’s top trading partner, it is in fact China who leads on trade with India – that is when adding results with Hong Kong, treated as a separate jurisdiction under the Indian Ministry of Trade accounting standards.

An Economy Resolutely Turned Towards The East.

The Indian economy is fundamentally turned towards trade with the Eastern hemisphere (63% of trade, YTD) rather than exchanges with the West. Indonesia, Singapore and Japan as well as economies such as South Korea are India’s main partners outside of China, although all the above belong to a group of countries friendly or dependent on Western relations for the realisation of their economic and political goals. Trade with Western countries appear more as outliers, though as a bloc the EU pulls significant weight (9% of trade YTD) per the Indian Ministry of Trade and Commerce.

Heavy Exposure To Commodities Exporters.

More than an East-West distinction, however, India’s economy is almost always in a structural current account deficit on account of its demographic weight and the demand for commodities this implies. Net exporters Saudi Arabia and Russia are both responsible for a significant amount of India’s total trade (a combined 7%) and cheap commodities rank high in priorities for the Indian government – also explaining India’s reserved stance on international affairs and most recently the steep discount Indian buyers have received on Russian oil as the Ukraine crisis unfolds.

2022 Investment Summary

India FDI Has Had A Record Year.

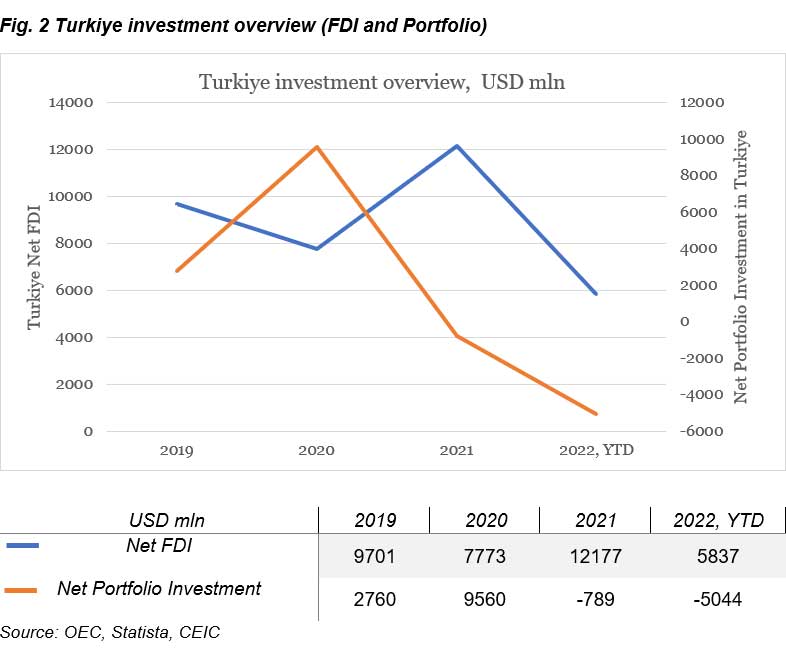

FY2021-2022 has seen record FDI numbers for India, with a net inflow of USD 84 billion as companies rush to fill the demand for production post-Covid and on the back of support from the Modi government’s “make in India” policy. Turkish inflows into India, however, are minimal.

Turkiye In Need of New Opportunities.

According to the investment data above, Turkiye has seen net outflows in terms of portfolio investment – a result of unorthodox macroeconomic policy from Turkey’s central bank that has spooked investors. That said, Turkiye’s devalued lira has continued to attract business seeking to localise production and generate a bigger ‘bang’ for every ‘buck’ invested in the country. Turkish economic volatility has still damaged the country’s reputation – explaining a drop of roughly 50% in FDI – but has been deep enough to deter the more opportune investors. As the smaller economy, Turkiye is more likely to be significantly impacted by inflows from India and certain sectors have been a boon – see Turkey Investment-for-Citizenship.

Trade in Goods

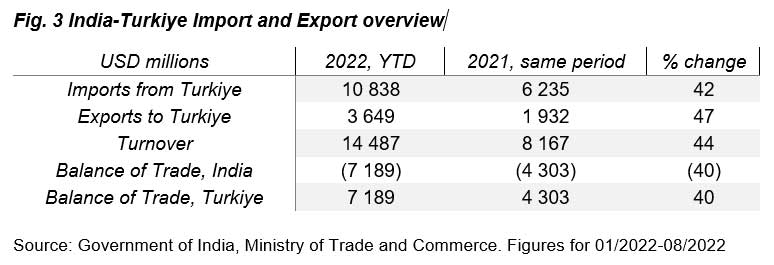

India-Turkiye Turnover Figures Have Nearly Doubled.

2022 YTD (January-September) figures for India-Turkiye trade show an over 40% jump in trade YOY, with turnover reaching a figure of USD 14 billion as India trade recuperates post-Covid. On a relative basis, however, trade YTD still only represents 1% of India’s foreign trade.

Turkiye Net Exporter to India For Foreseeable Future.

India’s structural deficit in foreign trade also applies to trade with Turkiye, running a USD7 billion deficit with regards to the former. Volumes have increased by over two-thirds, but the deficit did not increase: in percentage terms, the spread between exports and imports in 2021 and 2022 has remained remarkably stable at around 30%.

Strong YTD Figures for Turkish Exports.

Turkiye has racked up over USD10 billion in sales to India YTD – a figure worth near 1.5% of Turkiye’s GDP, making India a significant evolving player from Ankara’s point of view.

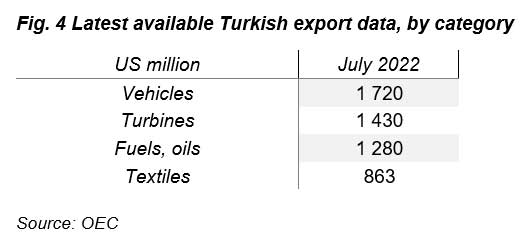

Typically, Turkiye’s main exports to India includes crude oil for those refineries, as well as vehicles and machinery such as turbines. India’s main exports to Turkiye are chemical products related to petroleum – especially refined petrol which it then re-exports to Developed Markets.

Future trends

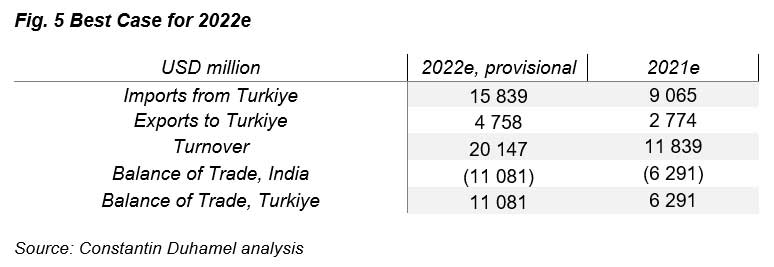

Moving Towards A USD20 Billion Trade Turnover.

Assuming the same intra-year dynamics and YTD figures, trade between the countries has the potential to rise to USD20 billion. Turkiye should be looking to countries like India to help boost its economy and the solid USD11 billion current account balance to be registered with the subcontinent by year end is a right step in this direction. This ought to be a very motivating prospect as Turkiye attempts to look to an export-oriented economy.

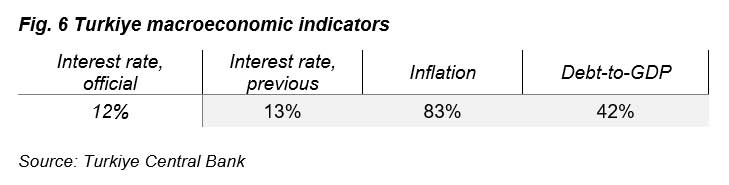

Drive For A Growth & Export-Oriented Economy.

Turkiye’s unorthodox economic approach seeks growth and exports at all costs. This means a loose monetary policy and a devalued Lira advantageous for firms turned towards exporting abroad. The effect, compounded by the energy crisis and a stronger dollar, is inflation far higher than any other peers and a crash in disposable income for Turks.

A Complicated Macroeconomic Situation.

Despite worrying inflation figures and the political mandate to keep loans in the country cheap, Turkiye’s public finances are sound to the extent that it has ample room to contract more debt in order to finance its development programs. That said, rising interest rates in the rest of the world will make financing/refinancing on world markets more expensive for Turkiye and act as an additional drag on its macroeconomic performance – unless its local market can cater for all the government’s borrowing needs, which acts in any case as a ceiling for Turkiye’s development.

India & Turkey Are Very Much Interlinked.

Along with its BRICS peers and as an emerging market, Turkiye is very much dependent on prevailing winds in capital markets. Despite both looking to increasingly use the Lira and the Rupee in international transactions, the strength of the dollar in recent months (on the back of Federal Reserve rate hikes) have devalued emerging markets on a relative basis. This common ground condition ought to be the basis for future Turkiye-India economic relationship in seeking to adapt our world order to aims more suited to non-Western markets with increasing demographic, economic and ultimately political weight.

Turkish Citizenship By Investment

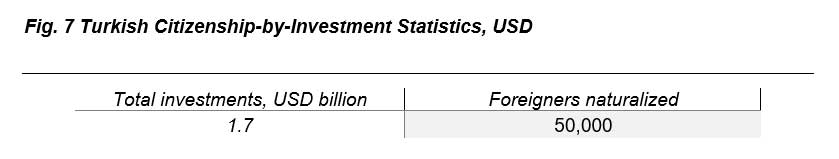

Unexpected Uptick in India-Turkiye Cooperation.

The most promising avenue for cooperation between Turkiye and India at the moment is Turkiye’s citizenship-by-investment program. Interest has peaked from Indian businessmen seeking to benefit from the countries location and geographical proximity to Western, Eurasian and Asian markets as well as visa-free travel to 120 countries – a far better state than that of Indian passport holders (visa-free travel to only 22 countries).

A Shared Islamic Heritage.

Without revealing numbers, the Indian press has recently revealed that leading members of India’s close to 200 million-strong Muslim community were seeking Turkish citizenship in exchange for investments starting from USD 400,000 – a relatively small sum in business terms – in real estate or USD 500,000 in cash deposits at a Turkish bank. Receiving Turkish residency almost immediately, investors and their family can subsequently benefit from a Turkish passport and its associated rights and privileges.

Favourable Terms of Business.

Turkiye is a relaxed jurisdiction that does not tax income generated from outside of Turkiye and does not impose capital controls or profit repatriation costs. There are, however, some issues from the Indian side as foreign investment by Indian individuals above a USD250,000 lump sum requires agreement from the competent authorities. That said, investments by tranches of USD250,000 is still possible.

Indirect Impact on Real Estate and Construction.

This clever move by the Erdogan administration seeks in effect to subsidise the labour-intensive real-estate and construction markets, which play into the government’s hand as it aims to deliver on its maximum employment mandate.

Summary

While the Turkish economy has its issues, some of these have been overly-impacted, such as the value of the Lira and the inflation rate, by US government policies and have resulted in Turkiye’s economy and currency being significantly under-valued. It has also suffered due to the impact of the West’s sanctions upon Russia, with spillage also occurring and resulting in a somewhat deflated initial value for Turkiye’s fundamentals. This can be expected to change from late 2022 onwards as the economy adapts to what many in Turkiye’s political and business establishment see as an opportunity.

Despite US opposition, Turkiye has remained on friendly terms with Russia and helped broker grain deals with Ukraine, an issue that has cemented Ankara’s position as stable and trustworthy, at least within the Eurasian region.

Turkiye’s strategic position as a huge bridge between the EU and Asia has also come much further into the spotlight as the Russian routes are now cut off, meaning that the Turkish routes, leading from the EU ports on the Black Sea to the Turkish Black Sea coast then overland by rail to the Caspian Sea have now become highly important Eurasian supply chains. These also stretch to India – from Turkiye these routes can reach Caspian Sea Ports at Azerbaijan and Iran, which can then divert them south via the INSTC, which bisects Iran north to south and exits Iran at its Persian Gulf Ports. From there, shipping to India’s west coast Mumbai Ports takes just 48 hours. That will become rather more obvious a play when the final segment of the INSTC double track railway becomes operational in mid-2023.

These developments mean that bilateral trade between the two countries is poised to significantly increase, as will transit trade for onwards destinations to Europe.

Import=Export businesses should take note as well as trade facilitators familiar with regional requirements, such as halal processing, cold storage, warehousing and repackaging / relabelling businesses.

On the basic export trade level, Turkiye has a middle class consumer base of about 43 million, accounting for 40% of its population. This continues to rise. India has a middle class consumer base of about 600 million, or 50% of the population, although being a huge country this population is segmented amongst India’s different states – analysis is need to pinpoint the required consumer base.

Dezan Shira & Associates maintains four offices in India and has a liaison partner in Turkiye.

Please refer to our ‘Setting Up In Turkiye’ article here and our complimentary ‘Doing Business In India’ publication here. For enquires about trade and investment with either Turkiye or India, please contact asia@dezshira.com

Related Reading

About Us

Middle East Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Dubai (UAE), China, India, Vietnam, Singapore, Indonesia, Italy, Germany, and USA. We also have partner firms in Malaysia, Bangladesh, the Philippines, Thailand, and Australia.

For support with establishing a business in the Middle East, or for assistance in analyzing and entering markets elsewhere in Asia, please contact us at dubai@dezshira.com or visit us at www.dezshira.com. To subscribe for content products from the Middle East Briefing, please click here.