New UAE VAT Ecommerce Rules Kick In From July 1st

International Ecommerce companies operating in the UAE need to get into compliance

From July 1, Ecommerce businesses operating in or with the UAE will need to make one key change in the way they book sales. This applies to these businesses’ compliance requirements under VAT regulations.

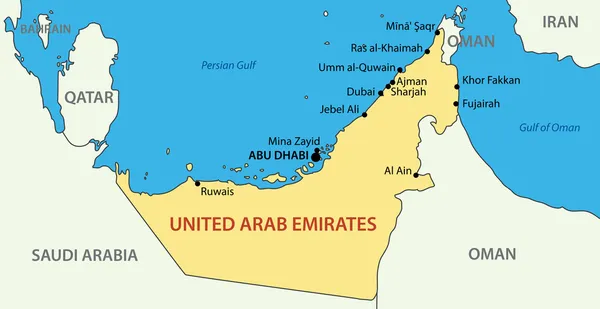

The UAE Federal Tax Authority has stated that ecommerce-generated sales need to enter in the VAT returns, the specific Emirate in which the order was placed, and the goods delivered. The UAE comprises of seven Emirates, including Abu Dhabi, Dubai, Sharjah, Ajman, Umm Al-Quwain, Fujairah, and Ras Al Khaimah.

However, this only applies to Ecommerce businesses that generate Dh100 million (about US$27.5 million) or more in a calendar year.

Typically, such sales reporting was done in the Emirate where the Ecommerce business establishment is located. Starting from July 1st this year, Ecommerce suppliers are required to report on orders in the emirate in which the supplies of the goods or services are received by the customer. It is a typical ‘location of supplier’ vs ‘location of customer’ principle.

Khalid Ali Al Bustani, the Director-General of the UAE FTA states that “Clear mechanisms have been outlined for the supply of goods and services via electronic means. This contributes to supporting the activities of this vital sector and ensure accurate tax compliance and reporting for e-commerce supplies.”

Ticking the Correct Emirati Box

The Emirate where the supplies are delivered must be declared in Box 1 of the VAT Return and can be done on the EmaraTax digital services platform.

Ecommerce suppliers are also required to maintain relevant supporting evidence regarding the location of the customer for all items.

Special Rules

New rules have been introduced to determine the Emirate against which relevant Ecommerce supplies are to be recorded and reported for VAT purposes. From July 1, this applies to taxable persons supplying goods and services through ecommerce and exceeding a threshold of Dh100 million in a calendar year for such relevant supplies.

What Ecommerce Businesses Need To Know

Ecommerce operators maintaining inventory in the UAE for future supplies could also be considered as conducting business in the UAE. The other typical issue is about the valuation of supply.

Depending on the nature of the discount schemes (offered by the online seller), the VAT implication could drastically change. If the discount is not funded by the supplier, the supplier would need to pay VAT on the amount received from the customers as well as the subsidy or price support received from the manufacturer or brand owner.

For UAE Ecommerce operators supplying to overseas markets, the export documentation and compliance proof need special attention.

Also Applies To Non-Resident Ecommerce Suppliers

Overseas based Ecommerce suppliers making deliveries into the UAE need to be VAT-compliant. Any income earned by a non-resident supplier from such supplies will trigger VAT registration compliance, including minor amounts. Accordingly, the Ecommerce operator should verify the ‘place of supply’ and the VAT status of the UAE customers. For example, most of the software and IT companies located in Ireland are already registered for UAE VAT.

Advisory

For assistance with getting prepared and in compliance, please contact Dezan Shira & Associates UAE office in Dubai: dubai@dezshira.com. It is important Ecommerce companies get these new procedures in place well before the July 1st deadline.

Related Reading

About Us

Middle East Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Dubai (UAE), China, India, Vietnam, Singapore, Indonesia, Italy, Germany, and USA. We also have partner firms in Malaysia, Bangladesh, the Philippines, Thailand, and Australia.

For support with establishing a business in the Middle East, or for assistance in analyzing and entering markets elsewhere in Asia, please contact us at dubai@dezshira.com or visit us at www.dezshira.com. To subscribe for content products from the Middle East Briefing, please click here.