Russian President Putin Visits Saudi Arabia and the UAE; Talks With Iran: The Political, Trade and Development Dynamics

Implications for Israel, Palestine, and future energy collaboration in addition to Caspian Sea trade between the Middle East, Russia, and Central Asia

The Russian President Vladimir Putin has been on an official visit to Saudi Arabia and the UAE, and is holding discussions with the Iranian President Raisi in Moscow today (Thursday, December 7). This whirlwind of activity has been partially prompted by the situation in Palestine, with Putin wanting to secure Russia interests in the Middle East, while also attempting to broker an agreement not to allow the Israeli situation to get out of hand. The West has largely parodied this as attempts by Moscow to insert itself into a regional peace policy, however the US Senate last night also voted against providing more military financial support for Israel. These developments place the onus on an Israeli settlement more firmly upon Russia and the regional actors themselves. I explain the rationale.

The Energy Dynamics

Oil

Russia is a significant global energy player, as are Saudi Arabia and Iran. The latter two countries are members of OPEC, which essentially sets the global oil supply and pricing. (The West’s decision to cap oil prices was partially an attempt to break this arrangement and move that decision making process to the United States). According to current estimates, 79.5% (1,243.52 billion barrels) of the world’s proven oil reserves are located in OPEC Member Countries, with the bulk of OPEC oil reserves in the Middle East, amounting to 67.2% of the OPEC total. Of these, Saudi Arabia and Iran possess the second and third largest reserves after Venezuela. Russia ranks eighth.

To put that into context, the United States and Canada jointly possess (the bulk being Canadian) 12% of global oil reserves. Europe doesn’t register and must import.

Gas

In terms of gas, Russia has the world’s largest reserves, followed by Iran, and Qatar. Saudi Arabia ranks sixth. Moscow, Riyadh, and Tehran alone possess 46% of all global gas reserves. In context, that compares with the United States and Canada with 5.3% of the total, while again, Europe has minimal reserves of about 2% including Norwegian and British reserves, and must import its needs.

Cooperation

Together with allies such as Nigeria and Venezuela, the OPEC/Russia bloc effectively controls the majority of energy supplies. At present, the minority share of this is enough to maintain Western economies for the next couple of decades, although Europe especially is now struggling having rejected Russian energy supplies and is becoming more reliant on Central Asia – an issue not without its own risks.

However, there are still significant untapped fields in Iran especially; with Russian already involved in developing these. Given the new diplomatic ties between Saudi Arabia and Iran, it can be expected that more Saudi/Iranian JVs will be developed – possibly with Russia in a mediating role – to further assist Iran with its energy programme.

But this will not stop with fossil fuels. Unlike either Saudi Arabia or Iran, Russia has a well-developed nuclear energy industry. Having Russia onboard to assist with this transition away from fossil fuels, and usage caps now largely agreed, will be a key aspect of future Russian cooperation with Riyadh and Tehran. It is no co-incidence that Putin arrived in the Emirates at the conclusion of COP28 as this has more than adequately addressed how the Middle East will manage fossil energy transitions and has provided a road map ahead.

Israel / Palestine

With Israel having managed itself into a position where even Washington’s support is waning – the onus on ending the Palestine conflict will increase. The United States will keep a military – mainly naval – presence in the Eastern Mediterranean to prevent a wider skirmish from occurring, however it seems the settlement issue over what happens in Palestine has now passed to regional players. Russia (and China) have long called for a two-state solution, and although details of how this will be defined remain unclear, the two other principal determining players here are Saudi Arabia and Iran.

The formation of a Palestinian State is likely to manifest. Israel will resist this; however, Washington is withdrawing support, bringing the eventuality somewhat nearer. Security will be a major issue, with Putin ready to supply military equipment and support to Palestine if agreed. Keeping the peace in a future Palestinian state will become a key part of Moscow’s regional influence; while helping cement ties and building trust between Riyadh and Tehran.

Bilateral Trade

Iran – Russia

In 2022, the trade turnover between Russia and Iran increased by 20% and amounted to US$4.9 billion. Existing trends indicate that the bilateral trade will continue to grow in 2023 and beyond, with some estimates suggested that it would be possible for the two countries to reach US$40 billion in bilateral trade. Since 2019, an interim Free Trade Agreement (FTA) has been in force between Iran and the Eurasian Economic Union (EAEU). Iran also joins the BRICS from January 1st, 2024.

More on the Iran-Russia trade dynamic here.

Saudi Arabia – Russia

Political and economic trends across Eurasia have pushed Russia and Saudi Arabia to seek closer ties. Riyadh seeks to diversify its foreign policy and foreign economic relations in order to implement its Saudi Vision 2030 strategic development programme, while it also seeks greater ties with Eurasian powers to balance its dissatisfaction with the West, and especially the United States.

Russia too needs Saudi Arabia. Sanctioned by the West, it seeks new export markets. The Arab countries, especially Saudi Arabia, earn on resale and re-exports from the various discounts that Moscow has to offer on hydrocarbons. Russia’s first direct rail freight exports to Saudi Arabia took place in August this year.

More on the Saudi-Russia trade dynamic here.

UAE- Russia

Russia’s re-orientation of trade from the West to Asia has benefited the United Arab Emirates (UAE). Trade has grown as has the bilateral investment potential. However, the Russia-West confrontation does not solely account for the burgeoning Russia-UAE ties. Those were steadily growing well before the outbreak of military hostilities in Ukraine. In 2022 their overall trade increased by almost 68% amounting to US$9 billion. Out of this, exports from Russia to the UAE reached US$8.5 billion, an increase of 71%.

At the same time, exports from the UAE increased by 6% to US$0.5 billion. The UAE is Russia’s 12th most important trade partner and ranks first among Middle East countries. The UAE is also Russia’s largest trading partner among the Gulf States.

More on the UAE-Russia trade dynamic here.

Trilateral Trade: Iran, Saudi Arabia, and the UAE

Key Russia’s regional relations is maintaining and developing ties between Saudi Arabia, the UAE and Iran. There are long-standing religious divides between them, with Iran being Shia and the Saudi/Emirates being Sunni Muslims. Both vie to be the dominant voice in Islam. Moscow will be keen to maintain their relations and ensure they do not veer off track – it arguably has the most to lose should diplomacy again break down. That said, it appears that Saudi Arabia, the UAE and now Oman – shortly to negotiate a trade agreement have long term ambitions in maintaining cooperative relations with Iran – it is strategically positioned as the Arabic world’s gateway to Muslim Central Asia as well as to Europe and Russia. Tehran may be difficult to deal with at times, but the benefits of good relations outweigh the alternatives.

We discussed Iran’s new trade relations with Saudi Arabia here and with the UAE here.

International Trade

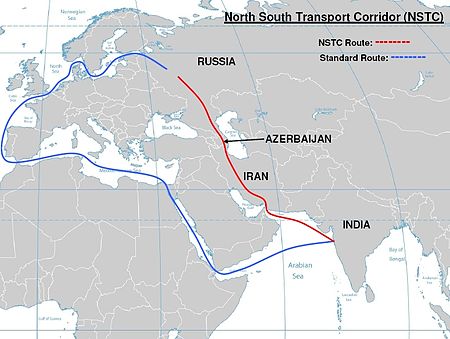

Moscow is keen to see the Northern Transport Corridor develop as it provides a faster and less expensive supply chain route between Russia and Asia than the Suez Canal. Iran is very much part of this, with its southern Persian Gulf ports (just opposite Saudi Arabia) connecting to its Caspian Sea ports and onward to Russia’s Caspian ports at Astrakhan. From there, Volga River and Rail access provide straightforward connectivity to over 20 Russian cities with populations in excess of 1 million, as well as to the main markets in Moscow and St.Petersburg. Iran’s Chabahar port is also just a day sailing from India’s Mumbai port. The same connectivity also applies to Saudi Arabia. Both Russia, Saudi Arabia and the UAE need Iran’s rail and road network and geographic connectivity.

Summary

Putin’s trip this week to Saudi Arabia and the UAE has been largely dismissed in the West, many not realising that the trip’s purpose also includes meetings with the Iranian President in Moscow, nor that it has coincided with COP28. What will have been discussed is not just the management of a post-conflict Palestine, but far greater cooperation in global energy flows and Eurasian cooperation.

With Moscow a primary player in Central Asia, and Iran, Saudi Arabia, and the UAE all part of the Shanghai Cooperation Organisation and BRICS, increasing ties between Russia and the Middle East, together with China are the new normal. With Washington now denying military aid to Israel, a major stumbling block to regional cooperation has been removed. The question now reverts to how the Muslim world will react to Israel – and specifically Benjamin Netanyahu’s role in the destruction of Gaza and the unseemly deaths of thousands of Muslim civilians. The post-conflict generation of Israeli politicians have a lot of ground to cover to remain part of the rapidly-developing Middle Eastern, MENA and Central Asian trade bloc, or risk being left behind. Saudi Arabia, Iran and the UAE are already plotting the region’s future direction and connectivity with Greater Eurasia – and are now including Russia in that process.

Chris Devonshire-Ellis is the Chairman of Dezan Shira & Associates. The firm assists foreign investors into the Middle East and has offices in Dubai. For assistance, please email dubai@dezshira.com and review our regional guides below.

Related Reading

RUSSIA’S PIVOT TO ASIA – How Russia and China Have Anticipated A New Cold War, The Impact On Western Sanctions Effectiveness And The Global Implications

RUSSIA’S PIVOT TO ASIA – How Russia and China Have Anticipated A New Cold War, The Impact On Western Sanctions Effectiveness And The Global Implications-

The Middle East Foreign Investment Trends with Focus on the UAE

The Middle East Foreign Investment Trends with Focus on the UAE

- Previous Article Iran, Oman, Planning To Sign Preferential Trade Agreement

- Next Article Getting Regionally Prepared For The Middle East’s New Tax Regimes