The UAE in BRICS: Consequences, Multilateral Trade and Prospect

The UAE’s bilateral trade with all major BRICS economies has rapidly grown. We look at the future development trends

By Farzad Ramezani Bonesh

The UAE’s Membership Process in BRICS

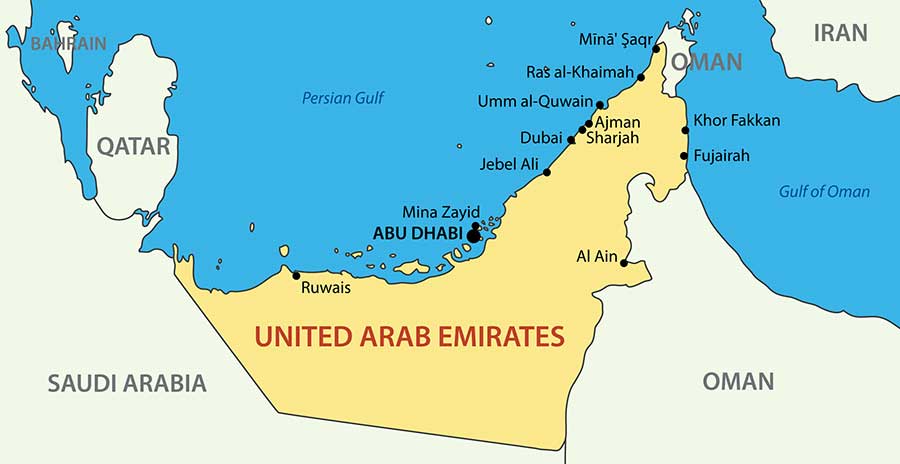

Over the past decade, the BRICS have become very attractive for Abu Dhabi, due to its increasing economic status and commercial capabilities. BRICS+ was an opportunity for the UAE to participate. As Abu Dhabi became a member of the BRICS New Development Bank (NDB), it also participated in BRICS meetings and summits.

Numerous leaders and officials of the BRICS countries have welcomed Abu Dhabi’s presence in the group in the past few years, while Abu Dhabi’s extensive relations with the main BRICS members made them welcome as a UAE BRICS partner. The recent 15th BRICS summit invited the UAE to become a full BRICS member from January 1, 2024.

Consequences and Opportunities of BRICS Membership for the UAE

The UAE will be considered an official BRICS member from January 2024. Sheikh Mohammed bin Zayed Al Nahyan, the UAE President, thanked for the invitation to join this group, while Sheikh Mohammed bin Rashid Al Maktoum, the Prime Minister, also considered the approval of the UAE’s joining BRICS as an indication of the success of the UAE’s international policy.

For the UAE, greater economic independence and strategic autonomy, multilateralism, attention to national interests, maintaining the balance of power with the US power in the Middle East, maintaining its traditional relations with the West, and diversifying partnerships all play significant roles in paying more attention to the BRICS participation.

Abu Dhabi looks at BRICS and other structures such as the Shanghai Cooperation Organization (SCO) as a way to increase geopolitical influence, strengthen geopolitical power and place of power in the world. It seems that Abu Dhabi doesn’t consider the BRICS (with about 26% of the area, about 42% of the world’s population), as a specific bloc, but more as a lever for diversification, strong participation, and cooperation at the international level and a common commitment to achieve stability and development and balance and preserving traditional relations with the West. This is especially since the White House does not see BRICS as a geopolitical competitor – its concern is more related to the development of the SCO.

Abu Dhabi joined the new BRICS Development Bank (NDB) in October 2021. Now, having more than US$1 trillion of its own sovereign capital, the UAE plans to allocate more capital to the New Development Bank.

UAE’s entry into BRICS will increase the influence and existing strengths of the bloc. In fact, the UAE’s full participation in the bank and board of the “New Development Bank” will likely lead to a greater role for the UAE in aid and soft loans in BRICS and even hosting the NDB’s regional office in the Middle East. Abu Dhabi has already secured the first overseas branch opening of the NDB’s cousin, the Asia Infrastructure Investment Bank (AIIB), which opened last month.

A large part of the UAE’s imports are from the BRICS countries, while BRICS investment in the UAE should also increase. UAE’s entry into BRICS also provides co-financing opportunities for the private investors of the country and greater market access to BRICS countries. With the presence of six new member countries in BRICS, they will control more than 40% of the world’s oil supply and more than 50% of gas reserves. With BRICS, the UAE can be involved with and assist coordinate global energy supply chains and energy security.

The UAE seeks to create a diversified economy, design a coherent financial policy, open markets, develop sufficient talent and global capital center, and taking steps towards the United Arab Emirates plan for 2071. The UAE economy reached 7.6% growth and GDP of US$599 billion in 2022.

From many perspectives, the BRICS help the UAE to reach its goals such as increasing tourists from BRICS countries, strengthening the knowledge-based economy, improving the position in renewable energy, increasing infrastructure, increasing the growth of the non-oil sector and the knowledge-based economy.

BRICS will also have a positive impact on the economy of the UAE, investments in the countries of the world, investment cooperation, stimulating exports, increasing trade exchanges, and attracting direct and joint investment. This is already apparent as the UAE imports about 85% of its food and can reduce supply chain costs and meet strategic food needs with BRICS.

With BRICS, Abu Dhabi can have access to forming alternative payment systems, and non-dollar financial systems, increasing trade with domestic currencies and creating a common currency, developing electronic commerce, and reduce reliance on the US dollar.

By joining BRICS, the UAE can have better access to benefits such as increasing non-oil exports, developing trade with emerging economies, benefiting from experiences, opening new markets, signing trade agreements, and accessing new member technologies.

UAE Bilateral Trade with the Major BRICS Economies

UAE and Brazil bilateral trade

Diplomatic relations between Brazil and the United Arab Emirates were officially established in 1974. Since 2000, the relationship has evolved and since 2008, the UAE has become Brazil’s second-largest trading partner in the Middle East. Increasing the number of official visits, advancing relations to the level of strategic partnership, the attention of the new government and the Halal initiative of Brazil, a highly complementary economy, the potential for cooperation in several business and investment sectors, the presence of the Arab community in Brazil, the collaboration of Mercosur and the GCC, the presence of more than 30 Brazilian companies in the UAE, the signing of bilateral memorandums of understanding and contracts, agreements to avoid double taxation and facilitate investment, have developed relations.

With investments of US$10 billion, and the presence of companies such as Mubadala, DP World, among others, the UAE is the largest Middle Eastern investor in Brazil. In April 2023, the UAE agreed to invest US$2.45 billion in Brazil over the next ten years. By developing deep strategic partnerships in major fields such as renewable energy, sustainable development, food security, and agriculture, Brazil ranks second among the most important trade partners of the United Arab Emirates in the Americas. The UAE is one of the biggest buyers of Brazilian products in the Middle East.

In 2021, the United Arab Emirates exported US$1.23 billion to Brazil, while Brazil exported US$2.42 billion to the United Arab Emirates. Brazil’s exports to the United Arab Emirates rose in 2022 to reach US$3.26 billion. Brazil has estimated that the total 2022 volume of trade between the two countries will increase to US$5.7 billion, if so, this represents a 74% increase over the previous year. The main exports of the United Arab Emirates to Brazil include oil, urea, sulfur, and aircraft parts.

The main products imported from Brazil to the UAE are chicken meat, beef, sugar, precious stones, metals, coins, waste, mineral fuels, and oils.

UAE and Russia bilateral trade

Russia’s 2023 Foreign Policy Concept emphasized the development of relations with various regional trade blocs, including BRICS and the Gulf Cooperation Council (GCC), together with the deepening of multilateral partnerships with the Organization of Islamic Cooperation, and playing a role in promoting peace, trade, and investment in the Middle East.

The two countries have long seen each other as partners in many issues, and the reorientation of Russian trade from Asia is in the UAE’s favor. Moscow and Abu Dhabi can cooperate on the development of bilateral trade, the reduction of trade barriers, the simplification of communications, the agreement on the establishment of a free trade zone within the framework of the EAEU, the establishment of a free trade zone, cooperation in Islamic financing, the establishment of Islamic banks, and the Halal food and products industry.

Apart from the mutual investment of the UAE and Russia, the growth of the number of Russian immigrants, the expansion of tourism from Russia to the UAE, the presence of 4,000 Russian companies in the UAE, the opening of the Russian section in the commercial center of Abu Dhabi, and the International North-South Transport Corridor (INSTC) will all be useful.

The presence of the UAE in the Shanghai Cooperation Organization, the discussion between the UAE and the member states of the Eurasian Economic Union (EAEU) regarding a free trade agreement, meetings of leaders and officials, cooperation in OPEC+, the UAE’s negative attitude towards Western sanctions, and the continuation of airline cooperation, has facilitated the expansion of relations.

Trade turnover between the United Arab Emirates and Russia has multiplied. In 2022, bilateral trade increased by almost 68% and reached US$9 billion. Exports from Russia to UAE (71%) increased to US$8.5 billion. Exports from the UAE reached US$500 million.

Russia has announced that the bilateral trade volumes are expected to reach US$10 billion by the end of 2023. The UAE is the first partner of Russia among the countries of the Arab world.

The re-export of Russian oil to other countries, using the UAE as a distribution hub will grow several times over the coming years, as European governments and buyers are still keen to access the resources but wish to cover up its origins. In non-energy trade, the share of precious stones and gold in the total exports of Russia to the UAE in 2022 reached almost 40% of the UAE’s total imports of these items. Russian investors have also been highly active in the UAE’s property market with Russian nationals in third place of expatriate investments into Dubai.

UAE and India bilateral trade

India and the UAE established diplomatic relations in the 1970s, and relations between the two countries have been greatly strengthened in recent decades.

Apart from the comprehensive strategic partnership agreement between the two countries in 2017, development of official visits, appreciation of 50 years of diplomatic relations, recent geopolitical and geoeconomic changes, and an Indian diaspora of professionals and expatriates of about 3.5 million people have all been grounds for substantial cooperation. Indians make up the largest non-Emirati group in the UAE, with 39.9% of the total population of the UAE. The increase of Indian remittances back to India has become a significant part of the overall Indian economy.

India and the UAE signed a Comprehensive Economic Partnership Agreement (CEPA) in February 2022 to immediately reduce tariffs, strengthen collaboration, and increase annual trade to US$100 billion.

The key sectors of agriculture and food, food security, energy, and services have had a significant impact on bilateral trade.

Apart from joint efforts to achieve energy security, the UAE is one of the largest energy suppliers of India and plays an important role in India’s strategic oil reserves. Abu Dhabi is committed to investing US$75 billion in India, while the presence of companies and groups, continuing the exchange of delegations, are all signs of the UAE’s continuing development economic presence in India.

The UAE is also becoming a major financial hub for India. With investments between US$55 – US$85 billion, the presence of more than 83,000 Indian companies, including construction, housing, manufacturing, tourism, and digital infrastructure, has been a boom for the UAE.

Bilateral trade between India and the UAE increased to US$84.5 billion in April 2022 – March 2023, a 16% year-on-year growth.

India’s exports to the UAE in the 2022-2023 fiscal year grew by almost 12% to reach US$31.3 billion. India’s imports from the UAE grew by 18.8% to reach US$53.2 billion in 2022-2023. (Year end April 2023).

India is the UAE’s second-largest trading partner, while the UAE is India’s third-largest trading partner after the United States and China.

In 2022, India’s major exports to the UAE were petroleum products, gems and jewelry, mineral fuels, oils, distillate products, pearls, precious stones, metals, coins, grains, electrical and electronic equipment, iron and steel, and machinery, nuclear reactors, and boilers.

In contrast, India’s major imports from the UAE include crude oil, gold, pearls and precious stones, ore and scrap metal, chemicals, electrical machinery, and son on. Much of the machinery and finished items were exports derived from Indian manufacturing in the UAE’s free trade zones, being a form of round-tripping as the UAE source was originally Indian investments designed to use the UAE trade zones as a spring board for Middle East and South Asian exports, including back to Indian markets.

The future of trade and economic relations with CEPA, removing more duties from exports, strengthening non-oil trade, solving the concerns of exporters, strengthening trade exchanges with two local currencies (Indian dirham and rupee), is likely to see UAE-India bilateral trade exceed US$100 billion by 2030.

UAE and China bilateral trade

China and the United Arab Emirates first established diplomatic relations in 1984. UAE-China relations are based on strategic partnership and cooperation and have seen significant growth in all fields over the past four decades. In 2018, bilateral relations became a “comprehensive strategic partnership”. The UAE is the largest logistics hub for China in the Middle East, while more than 60% of China’s trade in the region currently transits through the UAE.

China is the third largest foreign investor in the UAE. As a Belt & Road Initiative’s partner, the UAE is a prominent global gateway for Chinese businesses. The presence of the world’s largest container operator in Khalifa Port, the presence of a significant population of Chinese, encouraging the private sector to invest, and the presence of more than 4,000 Chinese companies, the expansion of cross-border e-commerce, will almost certainly lead to bilateral trade between the two countries reaching US$200 billion by 2030.

The active BRI projects in the UAE, the 10th Arab-China Business Conference with the signing of 30 investment agreements, the on-going Free Trade Agreement negotiations between China and the GCC, the active presence of dozens of Emirati companies in China, and energy transactions with the RMB Yuan, will lead to the continuous growth of relations between them.

China was also the UAE’s largest global trading partner with a bilateral trade value of US$69.2 billion in 2022, representing 18% growth. In 2021, China exported US$46.4 billion to the United Arab Emirates, while the United Arab Emirates exported US$22.8 billion to China. Since 2021, the UAE has been China’s number one trading partner in the Arab countries and the Gulf Cooperation Council.

The UAE mainly exports crude oil, petroleum gas, ethylene polymers and refined oil, pearls, mineral fuels, nickel, various chemicals, and coffee constitute the most imported products to China. The UAE’s main imports from China are equipment, computers, pharmaceutical products, iron and steel, and steam boilers.

UAE and South Africa bilateral trade

The UAE and South Africa have a strong and growing trade relationship that dates back to the late 1980s. South Africa is the second largest trading partner of the United Arab Emirates in Africa. Free trade agreement between the two countries, the exchange of several high-level visits, several daily

flights, the presence of a large South African diaspora in the UAE, and support for new sectors of industry, have developed relations.

About 17 UAE FDI projects have been registered as investments in South Africa, while 27 FDI projects from South Africa are also being implemented in the UAE. In 2021, the United Arab Emirates exported US$2.1 billion to South Africa, while South Africa exported US$4.47 billion to the United Arab Emirates.

Bilateral trade increased to US$6.5 billion in 2022. Apart from gold, South Africa is a major exporter of steel, base metals and products, steel, machinery, electronic equipment, mineral materials, and fuels. About 29 70% of South Africa’s imports from the United Arab Emirates revolve around crude oil. Other UAE exports are related to machinery, transportation equipment, consumer electronics, home appliances, ball bearings, computer accessories, and textiles.

The UAE – BRICS Vision

The BRICS is still not a full international or regional organization and is more informal. There is some inconsistency between some members, however a looser managed bloc can also have benefits – rather than a rigid trade agreement, intra-BRICS tariffs can be arranged on an as-need bilateral basis thereby negating the necessity of years of trade negotiations, a point often lost in Western analysis.

This means that the overall BRICS trade flexibility can be an important opportunity for the UAE in all geopolitical and geoeconomic dimensions, including the country’s soft power. Certainly, the potential of BRICS members can be of great help to facilitate the UAE’s goals.

The UAE’s membership in BRICS in the short and medium term can lead to foreign direct investment, overcoming the economic challenges of the UAE, and access to a 2030 perspective. Despite the UAE’s ambitious initiatives aimed at diversifying its economy and reducing dependence on oil, joining BRICS is a strategic step.

It means membership for the UAE can help create positive international multilateral partnerships, being a partner for both North and parts of the world, a gateway between East and West, achieving a global trade and logistics center, and a center for exports and re-exports in the world. BRICS can also help Abu Dhabi achieve the Vision 2030 goals, the UAE’s 2050 energy strategy, becoming a logistics superpower, a regional hub in global chains, expanding tourism, doubling the GDP by 2030, and increasing the per capita GDP of UAE nationals and residents.

Related Reading

- The Expanded BRICS – 84 Countries with a Collective GDP of US$83.5 Trillion

BRICS & MENA: New Analytical Report

BRICS & MENA: New Analytical Report

About Us

Middle East Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Dubai (UAE), China, India, Vietnam, Singapore, Indonesia, Italy, Germany, and USA. We also have partner firms in Malaysia, Bangladesh, the Philippines, Thailand, and Australia.

For support with establishing a business in the Middle East, or for assistance in analyzing and entering markets elsewhere in Asia, please contact us at dubai@dezshira.com or visit us at www.dezshira.com. To subscribe for content products from the Middle East Briefing, please click here.

- Previous Article Russian Investors Developing ‘Little Moscow’ in Dubai

- Next Article Abu Dhabi’s Non-Oil Sector Grew 12.3% In Q2 2023