The UAE – Indonesia Trade Agreement: Benefits for UAE Based Exporters

Indonesia has cancelled import tariffs for 80% of UAE exports

Indonesia and the United Arab Emirates (UAE) concluded a new free trade agreement under the UAE-Indonesia Comprehensive Economic Partnership Agreement (IUAE-CEPA) in July 2022. UAE President Sheikh Muhammad bin Zayed and Indonesian President Joko Widodo witnessed the signing in Abu Dhabi.

The free trade agreement removes trade barriers for a variety of goods and services with the aim to increase bilateral trade to US$10 billion by 2030 from the US$4 billion in 2021. The UAE enjoyed a trade surplus with exports to Indonesia totaling approximately US$2.1 billion and imports worth US$1.9 billion from the archipelagic nation.

This is the third trade deal signed by the UAE this year following CEPA’s with Israel and India. The Middle East’s finance and tourism hub is trying to diversify its economy away from hydrocarbons and deepening trade ties with the fast-growing economies in Asia and Africa. The UAE wants to remodel itself as a finance and business hub.

Emirati Minister of State for Foreign Trade Thani Al Zeyoudi stated that the trade pact with Indonesia would create 55,000 highly-skilled job opportunities by 2030 in the UAE.

The ratification is targeted to be completed by the end of 2022 by both countries.

Current UAE-Indonesia trade

Of the total US$4 billion in bilateral trade, the UAE exported over US$1 billion worth in petroleum and its related products in 2021. This was followed by more than US$200 million in iron and steel, and over US$100 million in aluminum.

The remaining export of goods came from precious stones, precious metals, sulphur, cement, and pharmaceuticals.

Indonesia’s largest export to the UAE was palm oil and its related products which was valued at over US$290 million in 2021. In addition, Indonesia also exported precious stones, precious metals worth over US$200 million, and over US$170 million in vehicles and their accessories. The country also saw more than US$150 million in exports of electrical machinery and equipment.

What does the IUAE-CEPA cover?

While waiting for the full text of the IUAE-CEPA to be ratified, both governments have highlighted several sectors that will benefit from the removal of trade tariffs. Under the deal, over 80 percent of UAE exports will gain duty-free access to Indonesia and Indonesian palm oil, food products, fashion wear, and other products and commodities will benefit from the reduced or eliminated tariffs.

Both countries are also expected to increase investments and cooperation in the areas of agriculture, energy, infrastructure, logistics, healthcare, and tourism. Furthermore, Indonesia and the UAE will increase cooperation in emerging sectors like renewable energy, Islamic finance, the digital economy, and automation.

Other MoUs and protocols signed in the meeting include:

- An MoU between the UAE’s Ministry of Health and Prevention and Indonesia’s National Agency Drug and Food Control to enhance cooperation in vaccine and drug monitoring;

- A cooperation protocol in the defense sector;

- A contract for the purchase of a landing platform between the Tawazun Economic Council and Indonesian state-owned company PT PAL, which manufactures ships for military and civilian use; and

- The implementation of a joint project aimed at growing mangroves between the UAE’s Ministry of Climate Change and Environment and the Coordinating Ministry for Maritime and Investment Affairs of Indonesia.

Why should UAE businesses invest in Indonesia?

Sound economy

Indonesia’s sound economic policies have contributed to investment growth reaching five-year highs up to 2019. Between 2000 and 2010, the economy grew steadily at an average 5.2 percent, a pace that was exceeded only by China and India, and the World Bank predicts that Indonesia will be one of the six countries that will account for more than half of all global growth by 2025, the others being China, Russia, India, Brazil, and South Korea.

This is a huge development considering that the economy shrunk by 13.7 percent during the Asian financial crises with the worse sectors being construction (-39.8 percent) finance (-26.7 percent), and the retail trade, hotel, and restaurant industry (-18.9 percent). Furthermore, the share of Indonesians living in poverty rose to around 24 percent.

The economy is projected to accelerate to 5.1 percent for 2022

Huge domestic market and expanding middle-class

Indonesia’s middle-class has been growing faster than other groups, with at least 52 million Indonesians now considered economically secure; or one in five. The middle-class now represents close to half of household consumption in the country compared to just 12 percent in 2002. As such, Indonesia’s economy is primarily driven by domestic activity, giving it an advantage during the global financial crisis in 2008 as well as through the COVID-19 pandemic.

The expansion of this group will be key to unlocking Indonesia’s developmental potential. The middle-class is expected to reach 90 million by 2030 and some additional US$1.1 trillion in business opportunities. This led to increasing urbanization and some 56 percent of the Indonesia’s total population live in urban areas and cities.

Moreover, Indonesia already has the world’s fourth largest population will enjoy a demographic bonus until 2030, when the share of the population in working ages will be at its highest level and thus the potential for increased output per capita. This is compared to its peers Singapore, Malaysia, and Thailand who are experiencing an ageing population.

Indonesia Offers Access to the RCEP

On August 30, 2022, Indonesia’s parliament has approved the country’s membership in the Regional Comprehensive Economic Partnership (RCEP) trade pact and became the latest country in ASEAN to join in what is the world’s largest free trade agreement. The RCEP is estimated to cover 30 percent of the global GDP of US$25.8 trillion and comprise 30 percent of the world’s population.

Importantly the RCEP presents ample opportunities for UAE investors particularly since Indonesia is looking to better integrate into regional value chains and attract investments.

We highlight the sectors that have huge potential for UAE investors.

Manufacturing

The government aims for Indonesia to become a manufacturing hub that rivals Germany and South Korea.

Indonesia’s main areas of production are textiles and garments, electronics, automotive, footwear, food and beverages, and chemicals. The country’s trade-to-GDP ratio is 40 percent, lower than the global average of 55 to 60 percent, highlighting that Indonesia is poorly integrated with global supply and value chains.

During the 1990s, Indonesia saw large-scale industrialization due to deregulation and a policy shift towards export-oriented industries. However, the country was slow in accumulating technology and reskilling its human resources, leading it to fall behind in its manufacturing competitiveness compared to Singapore, Malaysia, and Thailand.

Indonesia’s strength lies in its extensive natural resources and the processing industries associated with them. Membership in the RCEP can incentivize new investments and partnerships to obtain the technology and resources for expanding industrial capabilities and promoting innovation, besides enabling the climb up the value chain.

Downstream commodities

Indonesia hopes that the RCEP will allow for greater investments into its downstream industries, particularly in commodities processing. Oil and gas and minerals play a significant role in Indonesia’s economy and constitute a major source of revenue for the government.

The government is planning to ‘hit the brakes’ on the exports of almost all commodities. Unprocessed nickel was banned from being exported since January 2021 and the ban on raw bauxite shipments will begin in 2023, followed by raw tin exports in 2024.

To put in perspective, in addition to having the world’s largest nickel reserves, Indonesia is the second-largest producer of tin, the third-largest producer of coal, and the fifth-largest producer of bauxite. In January 2022, the government imposed a one-month ban on thermal coal exports to avail of a domestic shortage. The ban caused market prices in Asia to jump to US$160 per ton, but it did protect Indonesian consumers from a surge in energy prices.

Further, Indonesia is the world’s largest producer of crude palm oil, accounting for 60 percent of the global share.

The digital economy

Digital technology will play a leading role in Indonesia in reforming key sectors like healthcare and manufacturing in addition to improving the country’s resilience to disasters like the COVID-19 pandemic.

A 2020 report conducted by Google, Temasek Holdings, and Bain & Company concluded that Indonesia’s digital economy is expected to be valued at US$124 billion by 2025, largely powered by e-commerce, online travel, ride hailing, and online media. This will be facilitated by the country’s vibrant technology sector, supported by one of the highest concentration of startups in the world. There are currently over 2,100 startups in Indonesia, which is preceded only by the US, India, UK, and Canada. From this large number, five have achieved unicorn status and one is a decacorn.

Value of the Internet Economy of ASEAN-6 (US$ billion)

| Country | 2020 | 2025 |

| Indonesia | 44 | 124 |

| Malaysia | 11.4 | 30 |

| Philippines | 7.5 | 28 |

| Singapore | 9 | 22 |

| Thailand | 18 | 53 |

| Vietnam | 14 | 52 |

Source: e-Conomy Report 2020, Google, Temasek Holdings, and Bain & Co

Indonesia is Southeast Asia’s largest and fastest-growing internet economy – more than 170 million Indonesians had access to the internet in 2020, with 10 percent engaging in online shopping.

E-commerce is the driving force behind the transformation of Indonesia’s retail landscape, and the country’s gross merchandise value (GMV) was the third highest in the world at US$40 billion, beating India at US$38 billion.

Indonesia thus presents ample and scalable digital opportunities for foreign investors, particularly in e-commerce, fintech, and the Internet of Things (IoT). In trying to fully capitalize on this growth potential, Indonesia’s government issued new digital and e-commerce tax laws in 2020, a sign of the improving regulatory landscape.

This presents unique opportunities for foreign businesses in entering the country’s retail market, in particular. Notable foreign e-commerce platforms that have taken advantage of Indonesia’s large consumer market are Singapore’s Lazada and Shopee, who garner over 140 million monthly visits between them. Indonesian e-commerce giant, Tokopedia, saw an average 86 million monthly visitors in 2020.

Financial technology

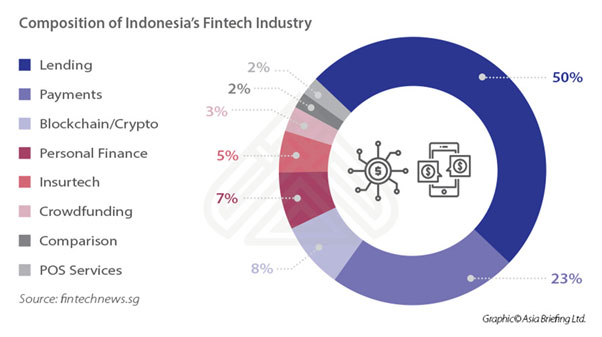

Indonesia’s fintech industry is one of the most competitive and dynamic in ASEAN as evidenced by the emergence of four unicorns and one decacorn in the industry. The country is home to 20 percent of all fintech companies in the Southeast Asian bloc, which is expected to generate US$8.6 billion in revenues over the next five years, despite its infancy.

The fintech industry is one of the most funded sectors — along with e-commerce — and is dominated by peer-to-peer (P2P) lending (50 percent) and e-payment (23 percent) platforms. Despite having more than 300 fintech companies operating in Indonesia, foreign investors will find the industry has yet to fulfil its potential. One of the factors is that 60 percent of the country’s workforce is in the informal sector, and many micro, small, and medium sized enterprises (MSMEs) have little access to financing from banks, as they too are mostly operating in the informal sector.

Establishing A Business In Indonesia

Investors should assess their specific needs carefully before deciding which corporate structure to operate from. Using a reliable local advisor is recommended for first-time investors in the country, as they find it easier to remain compliant with applicable regulations.

There are two legal options for foreign investors looking to set up in the country: a PT PMA or representative office (RO).

Foreign investment company

Establishing a foreign investment company or PT PMA, is the preferred structure for companies looking to have a legal presence in the country. Foreign investors will need to have a minimum paid-up capital equivalent of 10 billion rupiah (US$696,000), an increase from the previous 2.5 billion rupiah (US$174,135), as the government aims to attract more high-value investments into the country.

Set up requirements for a foreign investment company

According to the Investment Coordinating Board Regulation No. 4 of 2021 (BKPM Reg 4/2021), investors looking to incorporate a PT PMA need to adhere to the following requirements:

- A minimum paid up capital of 10 billion rupiah (US$696,000) to cover operational activity;

- Appointment of two shareholders (these can be foreign individuals or corporations – the percentage of local involvement will depend on the foreign ownership limitation based on the Positive Investment List);

- The appointment of at least one commissioner and a director (these can be held by foreign individuals), although it is advisable to have one local director for the ease of administration; and

- The director will be responsible for running the day-to-day activities of the company.

Risk based business licensing for a PT PMA

Government Regulation 5 of 2021 (GR 5/2021) — an implementing regulation of the Omnibus Law — introduces new criteria on how business licenses are issued in the country.

Business licenses will now be issued based on the assessment of ‘business risk level’, determined by the scale of hazards a business can potentially create.

To determine the risk level, the government will conduct a risk analysis of each application before deciding on issuing a business license. This will comprise of:

- Identifying the relevant business activity;

- Assessing the hazard level;

- Assessing the potential occurrence of hazards;

- Determining the risk level and business scale rating; and

- Determining the type of business license.

Based on the aforementioned risk analysis, the businesses activities undertaken by the applicant company will be classified into one of the following risk-level types:

- Low-risk businesses;

- Medium-low risk businesses;

- Medium-high risk businesses; and

- High-risk businesses.

Based on this risk-based approach, the lower the business risk, the simpler the business licensing requirements will be.

Representative offices

Opening a representative office (RO) is the fastest and simplest way of establishing a legal entity in the country. This set up is a temporary arrangement – ROs are not allowed to engage in any commercial activities, issue invoices, sign contracts, or earn any revenue. Foreign investors, however, can own 100 percent of this business entity and don’t have to contribute the same paid-up capital required by PT PMAs.

Indonesia’s Omnibus Law has made amendments to ROs and introduces four types:

- Foreign representative office (FRO);

- Representative office for a foreign trading company (TRO);

- Representative office for a foreign construction company (BUJKA); and

- Representative office for a foreign electricity company (JPTLA).

In addition, the law has simplified the process for establishing an RO in Indonesia.

The business activities of ROs are limited to – market research activities, obtaining information on potential clients, developing trade contacts, and gather information on regulations and laws. However, a BUJKA and JPTLA can generate revenue.

Foreign representative office (FRO)

An FRO is ideal for investors who are still exploring opportunities in Indonesia. The FRO is limited to non-commercial activities and there are no restrictions on the employment of foreign nationals. However, if an FRO does employ foreign workers, then it is also obligated to employ Indonesian citizens.

FRO’s are limited to:

- Acting as a liaison, coordinator, or supervisor to the foreign parent company;

- Preparing for the incorporation of a foreign investment company in Indonesia;

- Not participating in the management of the parent company’s branch office or subsidiary in Indonesia; and

- Not seeking revenues from Indonesia.

The FRO must be incorporated in an office building in the capital city of any province in Indonesia. Further, FROs are classified as low-risk business entities and thus only requires a business identification number (NIB) and an FRO registration to begin operations.

Representative office for a foreign trading company (TRO)

A TRO acts as a selling, buying, or manufacturing agent for the foreign parent company and is prohibited from engaging in any trade or sales activities. To establish a TRO, an NIB and a TRO Business License for the Trade Sector (Surat Izin Usaha Perwakilan Perusahaan Perdagangan Asing Bidang Perdagangan Melalui Sistem Elektronik – “SIUP3A Bidang PMSE”) is required.

Each TRO must have a SIUP3A, and if the TRO wants to conduct imports, then must be done through a local company holding a business license or a foreign investment company holding a general import identification number.

Foreign e-commerce organizers must establish a TRO if they fulfil the following criteria:

- Having more than 1,000 transactions with customers within a one-year period; and/or

- Delivered over 1,000 packages for customers within a one-year period.

Representative office for a foreign construction company (BUJKA)

A BUJKA is an RO for foreign construction companies, and unlike the KPPA and KP3A entities, a BUJKA can undertake projects in Indonesia through a joint venture with a local construction company. the BUJKA entity is required to obtain an NIB and a business entity certificate (Sertifikat Badan Usaha) (SBU).

In addition to making a joint venture with a local construction firm, the BUJKA is also required to adhere to the following:

- Fulfill all business licensing requirements;

- Hire an Indonesian as head of the BUJKA representative office;

- Utilizing sophisticated, efficient, and environmentally friendly technology;

- Prioritize the use of local construction materials;

- Employ more Indonesian workers than foreign workers in the expert level; and

- Carry out the transfer of knowledge and technology to Indonesian workers.

The joint venture with the local construction firm must also fulfil the various technical criteria such as stating the rights, responsibilities, and obligations in a written agreement between the cooperating businesses.

Further, at least 50 percent of the cost value of any construction work undertaken by the joint venture must be done onshore, and at least 30 percent of the cost value of the project shall be borne by the BUJK entity.

Representative Office for a foreign electricity supporting services (JPTLA)

A JPTLA is a representative office for businesses in the field of electricity supporting services. The JPTLA must obtain an NIB and a business entity certificate.

The JPTLA business licensing is granted to the following activities:

- Construction of electricity installation;

- Consultation for electricity installation; and

- Maintenance of electricity installation.

The JPTLA can undertake high-cost electricity supporting services with the following threshold:

- Projects for the construction and installation of electricity infrastructure worth at least 100 billion rupiah (US$6.9 million); or

- Projects for the consultation in the field of electricity maintenance and installation worth at least 10 billion rupiah (US$696,000).

Further, the JPTLA representative office must appoint an Indonesian citizen in charge of the office and conduct technology and knowledge transfers to Indonesian workers. The JPTLA must prioritize the utilization of domestic products as well as use high-tech and environmentally friendly technology.

General set up requirements for ROs

Foreign investors looking to open general RO will need to fulfil the following requirements:

- Register through the OSS online system;

- The parent company’s Articles of Association legalized by a notary and the Indonesian Embassy of the parent company’s country of origin;

- Letter of Appointment by the Indonesian Embassy located in the parent company’s country of origin;

- Latest financial statements of the parent

- Letter of intent legalized by a notary and the Indonesian Embassy located in the parent company’s country of origin;

- Certificates demonstrating competency in the relevant industry or sub-sector;

- Lease agreements;

- Must be located in the capital of a province; and

- A letter that states the RO will not engage in any commercial activities in Indonesia.

As mentioned above, those seeking to open a BUJKA or JPTLA representative offices will require to obtain additional licenses.

How can UAE businesses assist Indonesian exporters to the UAE?

Indonesian exports to the UAE are projected to increase by 53 percent or rise by over US$800 million within the next 10 years, particularly for commodities such as palm oil and their derivatives. Moreover, with the UAE also operating as a trade hub in the Middle East, UAE businesses have the opportunity to assist Indonesian exporters to expand their export partners in the region, especially to Africa.

Dezan Shira & Associates have offices in Dubai and a practice in Indonesia, and can assist UAE based businesses into the Indonesia and ASEAN markets. Please contact us at asia@dezshira.com or view our ‘Doing Business In Indonesia” guide below.

Related Reading

About Us

Middle East Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Dubai (UAE), China, India, Vietnam, Singapore, Indonesia, Italy, Germany, and USA. We also have partner firms in Malaysia, Bangladesh, the Philippines, Thailand, and Australia.

For support with establishing a business in the Middle East, or for assistance in analyzing and entering markets elsewhere in Asia, please contact us at dubai@dezshira.com or visit us at www.dezshira.com. To subscribe for content products from the Middle East Briefing, please click here.