UAE – Russia: 2023-24 Trade and Investment Dynamics

Already bilateral dynamic trade will be further boosted as the UAE joins the BRICS

By Emil Avdaliani

Russia’s re-orientation of trade from the West to Asia has benefited the United Arab Emirates (UAE). Trade grows as does the potential for investments. However, the Russia-West confrontation does not solely account for the burgeoning UAE-Russia ties. Those were steadily growing well before the outbreak of military hostilities in Ukraine in February 2022.

The two countries have long seen each other as partners on numerous issues across the Middle East and tried to tap into each other’s lucrative markets. The UAE also strives for greater economic independence and tries to avoid fixation on West by fostering closer ties with other powers centers such as China and Africa. Expanding ties with Russia fit into this trend. The UAE’s invitation to join BRICS, which includes Russia, is a good example of this.

UAE – Russia Bilateral Trade

Between 2017-2022, the trade turnover between the UAE and Russia has grown by almost six times. In 2022 the overall trade increased by almost 68% amounting to US$9 billion. Out of this number exports from Russia to the UAE reached US$8.5 billion, an increase of 71%.

At the same time, exports from the UAE increased by 6% to US$0.5 billion. The UAE is Russia’s 12th most important trade partner and ranks first among Middle East countries. The UAE is also Russia’s largest trading partner among the Gulf States.

The UAE is Russia’s largest trading partner in the Gulf Region, accounting for 55% of Russia’s total trade with the Persian Gulf and 90%. Among Russia’s exports diamonds occupy a central position. Russia is one of the largest diamond producers in the world, and the UAE is one of the world’s largest diamond processing centers. The share of precious stones and gold in Russia’s total exports to the UAE reached almost 40% in 2022.

The re-orientation of trade from the West to Asia has produced a number of peculiar developments in Russia-UAE trade relations. For instance, though the UAE is a large oil producer, in 2022 it imported some 3.2 million barrels of Russian oil destined for re-export to other countries. This is however only a tiny fraction of how of the 242 million tons Russia exported in 2022.

Another development is that throughout 2022 the re-exporting from the UAE to Russia grew exponentially. Among the exported products, microchips have a central role. Total re-export of electronics and various related details to Russia grew by fifteen times reaching US$283 million mark and making up more than 50% out of 500 commodities the UAE’s exported to Russia in 2022.

The two countries have greater trade potential. Officials from the two countries often stress the need to expand trade and set concrete targets. Yet there remain numerous unexplored avenues to boost bilateral commerce. One of them is to sign an agreement on bilateral free trade.

Another possibility is to sign a free trade agreement between the UAE and the Eurasian Economic Union (EAEU) itself. Russian officials claim that negotiations are currently ongoing and that concrete results are forthcoming by the yearend.

So far, the trade dynamic between the EAEU and the UAE has been positive. From 2015 to 2021, bilateral trade quadrupled, reaching US$6.3 billion. Officials from Russia and the UAE also mention that the envisioned free trade agreement between the EAEU and the UAE will likely include a specific bilateral investment and trade agreement between the United Arab Emirates and Russia.

Another possibility is the development of transport corridors which are essential for the expansion of economic cooperation between the UAE and Russia. One of these is the nascent International North-South Transport Corridor (INSTC), which has seen meaningful development progress over the past year. Though initially construed as a project to link India and Iran with Russia, the INSTC could be of benefit to the UAE too. Given the recent positive developments such as de-escalation in the Gulf between Saudi Arabi and Iran, the UAE could look at the INSTC as a potentially viable project for the Gulf region to connect to Russia and Central Asia.

UAE-Russia Investments

By early 2020 the total amount of Russian investments into the UAE reached around US$1.1 billion. In 2021 the number stood at US$750 million. The UAE thus ranks first among the Arab states in terms of the volume of Russian investments, accounting for more than 42% of the accumulated direct investments from Russia into the countries of the region. As to the UAE investments in Russia, in 2021 they amounted to US$1 billion. By early 2023, the UAE was the leading Arab country in terms of investment (44%) in the Russian economy.

In 2022, 700 Russian companies were established in the UAE which increased their number to 4,000 presently operating in the Middle Eastern country. With the growth in the number of Russian immigrants, the demand for the services of Russian companies in the UAE has also increased. The number of Russian real estate buyers grew incrementally as did the number of real estate agencies set up by Russians.

In 2022 alone, Russians purchased real estate in the UAE for a total amount of more than US$500 million. Related to this trend is the growing tourist flow from Russia to the UAE which exceeded pre-pandemic figures – 1.2 million trips in 2022, which is some 60% more than in 2021.

To boost bilateral investments; the UAE has opened a Russian section within the Abu Dhabi trade hub in the KEZAD economic zone, which is aimed at attracting Russian enterprises from the Eurasian space to activities in a favorable investment environment. This is especially important against the backdrop of the upcoming signing of an agreement on free trade in goods between the EAEU countries and the UAE.

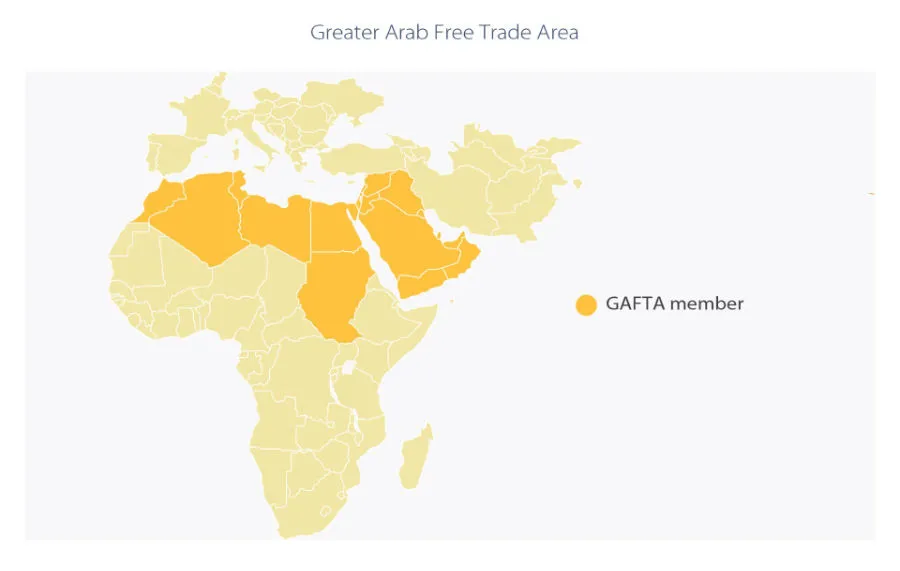

The UAE is also a member of the Gulf Cooperation Council (GCC) which includes Saudi Arabia, Kuwait, Qatar, Bahrain, and Oman. The Emirates are also a member of the Greater Arab Free Trade Area (GAFTA) which also includes Algeria, Bahrain, Egypt, Iraq, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Palestine, Qatar, Saudi Arabia, Sudan, Syria, Tunisia, and Yemen.

GAFTA’s population is about 440 million, while its total GDP (PPP) is about US$7.9 trillion. GDP per capita (PPP) varies widely among member countries; but averages out at US$17,270.

Russian owned businesses based in the UAE may also access these markets via the respective Free Trade Agreements.

Another measure for expanding investment ties is the work on a new double tax agreement (DTA) which is reportedly being carried out by Russian UAE officials. For instance, at the recent talks in Dubai on June 12, the parties agreed on a 15% tax rate on dividends, and a 10% rate on interest income. The purpose of the revision of the tax agreement is to reduce the cost of attracting investments from real investors.

Dezan Shira & Associates assist foreign investors into Asia and have done since 1992. We provide market research, corporate establishment, tax planning, trade compliance and other related business services. For assistance with UAE-Russia trade and development please contact Maria Kotova in our Dubai offices at dubai@dezshira.com

Related Reading

- The UAE’s Trade and Investment Dynamics with the BRICS

- The Expanded BRICS – 84 Countries with a Collective GDP of US$83.5 Trillion

About Us

Middle East Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Dubai (UAE), China, India, Vietnam, Singapore, Indonesia, Italy, Germany, and USA. We also have partner firms in Malaysia, Bangladesh, the Philippines, Thailand, and Australia.

For support with establishing a business in the Middle East, or for assistance in analyzing and entering markets elsewhere in Asia, please contact us at dubai@dezshira.com or visit us at www.dezshira.com. To subscribe for content products from the Middle East Briefing, please click here.

- Previous Article The UAE’s Trade and Investment Dynamics with the BRICS

- Next Article Saudi Arabia and Russia: The 2023 –24 Trade and Investment Dynamics