UAE Trade Relations With East Africa: Current Status & Prospects

East African GDP growth now significantly higher than global average

By Farzad Ramezani Bonesh

Introduction

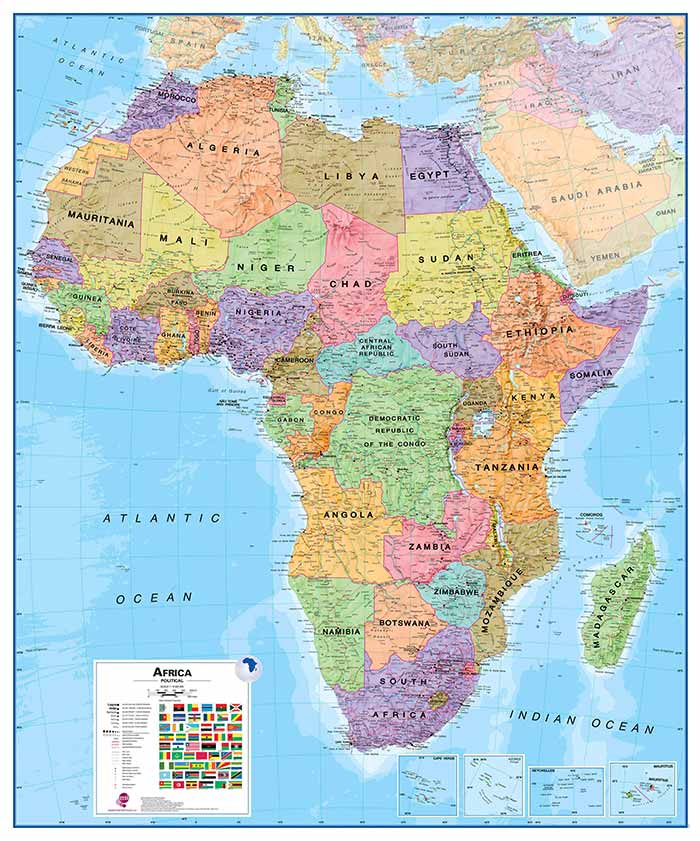

East African economies include Comoros, Djibouti, Eritrea, Ethiopia, Kenya, Madagascar, Malawi, Mauritius, Mozambique, Seychelles, Somalia, Tanzania, Uganda, Zambia and Zimbabwe, with eight of these showing annual GDP growth rates in excess of 5% and all bar two performing at higher rates than current global GDP growth. As such, they are attracting significant attention from the UAE, who sees infrastructure and investment opportunities.

The UAE Approach

Abu Dhabi, the capital of the UAE and heart of its diplomatic relations with East Africa have been growing after the UAE’s independence, and political relations have been strengthened and established with the region in recent years. Huge planning is involved, with major documents, plans, visions and strategies such as the Economic Vision 2030 and economic priorities of the UAE to regulate the overall foreign trade of the country.

The UAE economy achieved 7.6% growth and a GDP of US$599 billion in 2022. It seeks to create a diversified economy, design a coherent financial policy, open markets, develop sufficient and flexible infrastructure, and economic growth, empower financial markets, strengthen its position as a center for new exports, a talent center and for global capital, and is taking steps towards the UAE Centennial Plan for 2071.

The UAE is also investing in making extensive efforts to achieve the goals of the 2050 energy strategy of the UAE, the economic vision of 2030 and the promotion of the position in renewable energy, the expansion of ports, commercial infrastructures, increasing the capacity of ports, increasing the growth of the non-oil sector , knowledge-based economy, and expanding tourism through to 2050.

In recent years, East Africa has been the fastest-growing region of the African continent, and most East African countries consider the development of international cooperation as economic and diplomatic priorities to attract UAE investment in basic sectors.

Many of these nations consider the UAE as a successful development model that specializes in urban development and infrastructure creation. Maintaining and improving the credit rating in the region, improving the world’s top ranks in the human development index and the food security index, becoming a logistics superpower, strengthening the aviation and tourism sectors, competition between the powers, strengthening economic cooperation and benefiting from economic growth are important in Abu Dhabi’s attention to this area.

Also, the UAE is maximizing its international trade share, diversifying foreign partners, strengthening the national economy, opening new markets, and increasing access to global markets for the export of non-oil goods and services in trade relations with East Africa. In addition, the UAE’s economic diplomacy has focused on promoting its position as a global trade hub and a global center for attracting foreign capital and a diverse and stable economy. This is why Africa has developed as being of substantial regional interest.

One of the important actions of Abu Dhabi in this region is the expansion of treaties, investments, and agreements, increasing cooperation with regional organizations, and improving the environment for investment and business development. In this regard, the European Union also wants to partner with the UAE in energy and infrastructure development in Africa, while the UAE and Israel have an additional joint plan to invest in Africa.

UAE aid has been provided as part of its economic diplomacy in East African countries to Somalia, Djibouti, Eritrea, and Ethiopia. Abu Dhabi has also learned that East Africa plays an important role in the UAE’s food security strategy.

Many countries in the region depend on agriculture with arable land. Efforts to reduce dependence on achieving food security have led to investment, land purchases, and better access to agricultural products in East Africa. East Africa’s growing infrastructure and energy needs are great opportunities. Over the past decade, the UAE has emerged as one of the largest investors in Africa.

The UAE is now the world’s fourth largest investor in Africa (after China, EU, and the US) and in 2018, financed more than 66 projects in 28 African countries. Companies such as DP World and Abu Dhabi Ports have projects and seaports in Angola, Djibouti, Mozambique, Somalia, and Tanzania.

| East African GDP & 2023 Growth Rate Forecasts (% growth) | ||

| Country | GDP (US$ Billions) | Expected 2023 GDP Growth |

| Ethiopia | E96.11 | 7.5 |

| Mauritius | 11.53 | 7.4 |

| Mozambique | 16 | 6.5 |

| Rwanda | 32 | 6.2 |

| Uganda | 41 | 6.2 |

| Kenya | 110.35 | 6.0 |

| Seychelles | 12.3 | 5.9 |

| Madagascar | 14.47 | 5.3 |

| Tanzania | 68 | 5.2 |

| Djibouti | 3.48 | 4.0 |

| Zambia | 65 | 3.9 |

| Zimbabwe | 28.37 | 3.8 |

| Somalia | 7.63 | 3.6 |

| Eritrea | 6.5 | 3.0 |

| Global Growth Forecast | 2.9 | |

| Comoros | 1.3 | 2.5 |

| Malawi | 0.12 | 1.6 |

Significant UAE-East Africa Trade Relations

Kenya

Kenya is the largest economy in East Africa and the gateway to East and Central Africa. A more developed infrastructure and emerging opportunities in this country have attracted Abu Dhabi’s attention.

Expanding business meetings between companies and individuals of the two countries, increasing investment, business relations with the agreement on faster trade agreements, examining investment partnerships in oil and gas, technology transfer, agriculture, health, and treatment, as well as the development of special economic zones, and negotiations on A Comprehensive Economic Partnership (the first between the UAE and an African country, (the UAE-Kenya CEPA) have effectively made the UAE Kenya’s second-largest market after China.

Trade has increased almost tenfold in the past decade. This growth is connected to the increasing demand for Kenyan exports in the UAE and the UAE’s investment in Kenyan infrastructure.

Negotiations between the UAE and Kenya on renewable energy and boosting non-oil trade between the two countries are ongoing.

Trade and investment between the two countries is currently US$2.3 billion. In 2021, the value of Kenya’s imports from the UAE was approximately US$1.83 billion, while Kenya’s exports to the UAE were approximately US$315 million. Kenya imports oil, broadcasting equipment, and plastic while exporting tea, flowers, fruit, and sheep and goat meat.

The UAE’s US$3.5 billion investment, present in key sectors such as tourism and Kenyan real estate, increased Emirates-Nairobi (NBO) flights, the presence of 50,000 Kenyans in the UAE, and other initiatives are such that Sheikh Mohammed bin Rashid Al Maktoum, the UAE Prime Minister, has identified Kenya as “one of the most promising business partners for Dubai” in the coming years.

Tanzania

Abu Dhabi has selected Tanzania as a priority country and key trading partner for the development of trade, investment, and cooperation in Africa.

Tanzania has abundant natural resources, an expected GDP growth of 5.2% in 2023, and with a series of developed ports is a vital sea gateway for many African markets. The second largest economy in East Africa, the country has numerous opportunities for partnership and cooperation with UAE and Tanzania in food security, logistics, tourism, and mining.

The signing of numerous memorandum of understanding at Dubai Expo 2020, the signing of effective contracts, and an agreement to remove double taxation barriers in trade between the two countries, has led to a wider cooperations between the two countries officials and leaders in 2022, including 36 MoU for a total investment of more than US$7.49 billion in key industry sectors such as energy, agriculture, tourism, infrastructure, transportation, textiles, information, communications technology, and construction. The DP World contract in Tanzanian ports, development of solar and wind energy projects in Tanzania, have made the UAE one of the largest trading partners of Tanzania.

In 2022, Tanzania was the UAE’s second-largest trading partner among East African countries after Kenya. The unprecedented growth of UAE-Tanzania non-oil trade reached US$2.5 billion in 2022 with an 11% growth rate compared to 2021. The major products exported by the UAE to Tanzania are refined oil, raw sugar, and automobiles.

Ethiopia

Ethiopia’s economic relations (trade and investment) with the UAE have made significant progress in the last two decades, with Ethiopia offering investment opportunities in the agricultural, manufacturing, and service sectors.

The UAE has become one of Ethiopia’s top trading partners. The trade relations between the two countries benefited the UAE and the UAE is one of Ethiopia’s four main export destinations (agricultural products and semi-processed goods). In return, it imports oil, vehicles, electronics, machinery, fertilizers, and other consumer goods from the UAE.

The UAE has also pledged US$3 billion (1 billion in aid, and 2 billion in investment) to support Ethiopia’s political and economic reforms.

The presence of Eagle Hills in the real estate project in Addis Ababa, the Khalifa Fund for Enterprise Development (KFED), and about 66 UAE investors in Ethiopia have increased UAE investment into Ethiopia to more than US$2.5 billion.

With some 200,000 Ethiopians in the UAE, the signing of an investment promotion agreement, the signing of bilateral investment agreements, more than 100 UAE investments in the agricultural sector, investment in the development of solar energy projects and renovation of industrial areas and bilateral trade of about US$1 billion annually, are important steps in developing the bilateral relationships.

In 2021, the UAE exported goods to the value of US$794 million to Ethiopia, mainly refined oil, jewelry, and cars. In 2021, Ethiopia exported US$1.05 billion to the United Arab Emirates. The main products were gold, other oilseeds, and sheep and goat meat.

Uganda

Uganda is a key gateway for the UAE in the African Great Lakes region. The UAE and Uganda have signed several economic agreements BASA, DTA, IPPA, TECA, and others to strengthen the cooperative relationship between the two countries.

The promotion of agencies, the signing of important investment contracts at the Dubai Expo 2020, Uganda’s strong presence at the Expo, finding opportunities in the agriculture and clean energy sectors, and similar deals increased bilateral relations with Uganda to US$3 billion in 2022.

Uganda’s exports to the UAE are pearls, precious stones, metals, and mineral fuels, oils, distillate products. With about 100,000 Ugandans in the UAE, the expansion of flights, and the emergence of Ugandan SMEs in the UAE have made the UAE one of the largest suppliers of goods to Uganda, and this is increasing.

UAE-East Africa Smaller Trade Partners

Trade between the UAE and the countries of the COMESA economic bloc has been increasing. Comesa includes Burundi, Comoros, Congo, Dem Rep., Djibouti, Egypt, Eritrea, Ethiopia, Kenya, Libya, Madagascar, Malawi, Mauritius, Rwanda, Seychelles, Sudan, Swaziland, Uganda, Zambia, and Zimbabwe.

The UAE’s ‘Dubai World’ project, and a special investment arm in Africa called ‘Dubai World Africa’ on Africa are focused on the African Continent, the Indian Ocean Islands, and about 30 investment projects in Djibouti, Mozambique, Rwanda, and Comoros.

In Somalia, in addition to aid, the UAE has signed a cooperation agreement with the Somali government. More than 100,000 Somalis work in the UAE. There is economic cooperation between the UAE and the Somalia, with the UAE managing Somalia’s ports.

The UAE was one of the first investors in Djibouti and has signed various agreements with the country in military security and economic cooperation. Emirates and ‘DP World’ have invested in the development and management of the port in Djibouti.

The Abu Dhabi Development Fund has invested in infrastructure projects as well as oil production and transportation projects in Eritrea. In 2021, the UAE exported US$105 million of products to Eritrea. The Emirates Investments Group has also expanded its geographical interest by investing in Gambia’s business, industry, and aviation sectors.

Zimbabwe’s main exports to the UAE include precious stones and pearls, tobacco, and fruits. Zimbabwe largely imports value-added products from the UAE. The two sides’ relationship is growing rapidly with the agreement on the promotion and support of investment.

Bilateral trade has increased to US$1.6 billion in 2021, making the UAE one of Zimbabwe’s largest trading partners.

The Seychelles and UAE also signed different agreements in the field of economic cooperation between the two countries, while the UAE and Mozambique have increased economic relations with long-term relations and the signing of a cooperation agreement. Recently, Zambia and the United Arab Emirates signed a US$2 billion contract to build solar power plants.

The UAE-East Africa Vision

Challenges such as terrorism, illegal African migrant workers, an insecure investment environment, and political fragility in some East African countries, are among the more significant challenges facing development process and progress in attracting UAE investments to East Africa.

Previous challenges such as prior bad investments in Somalia, and other regional disputes have slowed down the process of economic relations between the UAE and certain East African governments. East African countries are still not among the most important economic partners of the UAE. However, the UAE has expanded its diplomatic presence in the region in recent years. The UAE is among the top ten importers of goods and commodities for 10 African countries.

The value of UAE-African trade continues to increase at a higher rate when compared to the UAE’s total trade, while the UAE’s investment in Africa is significantly more than all other Middle Eastern players.

Due to the bilateral attention now being paid to UAE-East African cooperation and current trade trends, the prospects of economic relations and trade flows between the UAE and East Africa are encouraging.

Dezan Shira & Associates assists foreign investors in the region and has an office in Dubai. The firm also has numerous African professional services partners in multiple African countries. For assistance, please contact us at dubai@dezshira.com

Related Reading

- The African Continental Free Trade Agreement Starts From 1st January 2021.

- China’s African Belt & Road Initiative – It’s Not What You Think It Is

About Us

Middle East Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Dubai (UAE), China, India, Vietnam, Singapore, Indonesia, Italy, Germany, and USA. We also have partner firms in Malaysia, Bangladesh, the Philippines, Thailand, and Australia.

For support with establishing a business in the Middle East, or for assistance in analyzing and entering markets elsewhere in Asia, please contact us at dubai@dezshira.com or visit us at www.dezshira.com. To subscribe for content products from the Middle East Briefing, please click here.