The UAE offers multiple types of business entities, each with distinct benefits, obligations, and limitations. From Limited Liability Companies (LLCs) to Free Zone Entities (FZEs), each business structure is designed to cater to specific operational needs, financial capacities, and industry requirements.

Business jurisdictions in the UAE

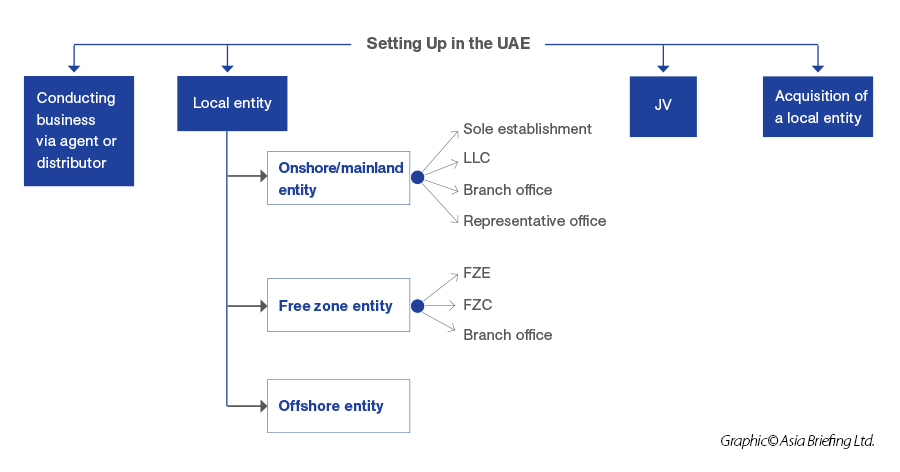

The UAE offers three primary jurisdictions for establishing a business: Mainland, Free Zones, and Offshore. Each jurisdiction provides distinct advantages tailored to different business goals, regulatory needs, and operational requirements. The choice of jurisdiction directly influences ownership options, taxation, permissible business activities, and other operational aspects, making it a crucial decision for investors.

Mainland Jurisdiction

Mainland companies in the UAE are established in the country’s onshore market, allowing them to operate freely both within the UAE and internationally. Businesses in this jurisdiction receive their licenses from the Department of Economic Development (DED) in the specific emirate where they are based.

Recent regulatory changes permit 100 percent foreign ownership in most sectors, adding to the mainland’s appeal for foreign investors. Mainland companies are suitable for businesses that plan to trade within the UAE market or take on government contracts. The UAE Commercial Companies Law (CCL) governs most economic activities in onshore UAE. Foreign businesses can operate in this jurisdiction primarily through:

- Limited Liability Companies (LLCs): Traditionally, foreign investors needed a UAE national to hold at least 51 percent of the shares in an LLC. However, recent amendments now allow for 100 percent foreign ownership in majority of sectors, still strategic sectors may require local ownership of 51 percent.

- Branches or Representative Offices: Foreign companies can establish branches or representative offices in the UAE, but these entities do not possess separate legal personalities and are not afforded limited liability protection. A representative office primarily focuses on marketing and promotional activities.

- Sole establishment: A sole establishment, or sole proprietorship, is a business owned and managed by a single individual who bears full personal liability for all debts and obligations, including exposure of personal assets. It offers 100 percent ownership, full operational control, and complete profit retention, with low setup costs, fast registration, and no minimum capital requirement. In the UAE, this structure is available to UAE and GCC nationals across commercial, industrial, tourism, and professional activities, while foreign nationals may only establish professional entities and must appoint a Local Service Agent.

The main advantage of having an onshore entity is the fewer restrictions on business activities and the flexibility in selecting business premises. Mainland companies have access to a range of business licenses:

- Professional;

- Commercial;

- Industrial; and,

- Tourism.

They also benefit from fewer restrictions on office location and business activity, providing greater flexibility compared to other jurisdictions. However, some strategic industries, such as financial services, require UAE national ownership or partnership for licensing. Additionally, a mainland setup may require a larger initial investment and compliance with local laws governing employment, accounting, and company structure.

Free Zone Jurisdiction

Free Zones are designated areas within the UAE specifically created to promote foreign investment by offering favorable terms for international investors. Each free zone operates under its own authority, providing licenses, residency visas, and infrastructure tailored to specific industries, such as logistics, technology, or media. Free zones offer 100 percent foreign ownership, tax exemptions on imports and exports, and full repatriation of profits and capital, making them an attractive choice for foreign entrepreneurs.

The UAE boasts over 46 free zones, with each zone catering to different business needs and regulations. However, free zone companies are generally restricted to operating within their respective free zone and are not permitted to conduct business directly in the mainland market without appointing a local distributor or setting up a mainland branch.

While mainland companies will also need to rent physical addresses and provide lease agreements (“Ejary”), free zones allow flexibility of registering the company without the actual physical address but under the flexi desk if the number of employees is small (generally under 4 visas). However, for some sectors, the bank will require a physical office even for the companies in the free zones.

Free zone licenses permit business activities within the specific free zone but also allow for transactions with customers in other jurisdictions. Common entity types in free zones include:

- Free Zone Establishment (FZE): A single shareholder company.

- Free Zone Company (FZC): A company with two or more shareholders.

- Branch of a Foreign Company: Similar to onshore branches but tailored to the free zone's regulations.

Offshore Jurisdiction

Offshore companies in the UAE are established primarily for the purpose of international business and asset management outside the UAE, making them distinct from free zones and mainland entities. Offshore companies are registered by specific offshore authorities, with options available in Jebel Ali Free Zone (JAFZA), and Ras Al Khaimah (RAK).

Offshore companies are not permitted to conduct business within the UAE market, but they benefit from tax neutrality, privacy, and confidentiality protections that make them popular for holding assets, conducting global trade, or managing wealth.

Offshore companies offer flexibility in terms of ownership, with full foreign ownership allowed. They also provide benefits like no corporate tax, full profit repatriation, and international invoicing capabilities. Offshore entities are often used by investors seeking to establish a presence in the UAE without a physical office or local hires, as these companies do not have residency visas or office lease requirements.

For businesses not planning to engage in activities within the UAE, offshore company formation is an option. Offshore entities generally serve as holding companies and cannot conduct commercial activities or open bank accounts in the UAE. However, they can own freehold property in onshore UAE under certain free zone regulations.

Jebel Ali Free Zone (JAFZA) and Ras Al Khaimah International Corporate Centre (RAK ICC) are notable examples of offshore company jurisdictions. Benefits include no foreign ownership restrictions, no residency requirements for shareholders/directors, and no need for physical office space.

Advantages and limitations comparison

|

Jurisdiction |

Advantages |

Limitations |

|

Mainland |

|

|

|

Free Zones |

|

|

|

Offshore |

|

|

Types of business structures and establishment options

The UAE offers a flexible framework for business establishment, allowing foreign investors to choose structures that align with their commercial objectives, ownership preferences, and market access requirements. Options range from light-touch market entry models to fully established legal entities across mainland and free zone jurisdictions.

Market entry without local incorporation

Foreign companies can enter the UAE market through structures that require limited regulatory exposure and relatively low upfront investment.

One common approach is to operate through a local agent or distributor, leveraging established market knowledge and distribution networks; in most cases, distributors take ownership of goods and resell them locally, making this model particularly suited to trading, consumer goods, and industrial products.

Another widely used option is franchising, especially in sectors such as food and beverage, retail, health and fitness, education, and services, where a local franchisee manages day-to-day operations and regulatory compliance. This model allows international brands to scale quickly in the UAE while minimizing capital commitments and operational complexity.

Establishing a local presence

Foreign investors seeking direct operations can choose from several legal structures depending on activity and ownership needs.

| Structure | Key Features | Ownership and Liability |

| Sole Proprietorship | Simple setup, full control, suitable for professional services | Unlimited liability; foreign nationals require a professional license and Local Service Agent |

| Civil Company | Designed for professionals (consultants, doctors, engineers) | Full foreign ownership allowed; unlimited liability; LSA required |

| General Partnership | Shared management and profits | UAE nationals only; unlimited liability for all partners |

| Limited Partnership | Separates management and investment roles | Limited liability for non-managing partners |

| Limited Liability Company (LLC) | Most common structure; flexible operations | Limited liability; up to 100% foreign ownership in permitted sectors |

| Free Zone Company | Tax incentives, fast setup, sector-focused ecosystems | 100% foreign ownership; restricted mainland trading |

| Branch Office | Extension of parent company | No separate legal entity; parent bears full liability |

Advanced and strategic structures

Advanced and strategic business structures in the UAE are typically adopted by investors pursuing larger-scale projects, regulated activities, or long-term sector-specific strategies. Joint ventures (JVs) are commonly used where local market access or regulatory familiarity is essential, allowing foreign and UAE partners to share capital investment, operational responsibilities, and risk. For businesses seeking to raise significant capital or operate at scale, public joint stock companies (PJSCs) provide access to public markets, albeit with higher capital thresholds and regulatory oversight. Private joint stock companies (PrJSCs) offer a more controlled alternative, enabling a limited group of investors to retain governance influence while still benefiting from a formal corporate structure.

| Structure | Ownership Structure | Capital Requirement | Key Advantages | Typical Use Cases |

| Joint Venture (JV) | Foreign and UAE partner(s) | Varies by agreement | Local market access, shared risk, regulatory familiarity | Regulated sectors, infrastructure, industrial projects |

| Public Joint Stock Company (PJSC) | Public shareholders | Minimum AED 10 million (~US$ 2.7 million) | Access to public capital, scale, visibility | Large corporations, banks, insurance companies |

| Private Joint Stock Company (PrJSC) | Private shareholders (limited number) | Minimum AED 2 million (~US$ 545,000) | Greater control, structured governance, limited public exposure | Family offices, private investors, mid-to-large enterprises |

Licensing requirements

Each license type is tailored to specific business activities, with requirements varying by sector and location. Investors can obtain licenses from the Department of Economic Development (DED) in the relevant emirate, either at physical service centers or through online portals.

Overview of licensing types

Professional License

This type of license is designed for service-based activities, such as consulting, IT, education, and healthcare. Enables foreign investors to own 100 percent of the business, though a Local Service Agent (LSA) may be required. Generally, this license is chosen by individual professionals or specialist firms.

Commercial License

The license covers trading and commercial activities, including import/export, retail, and general trading. Commercial license allows businesses to engage in buying and selling goods within the UAE market and often selected by investors in trading, logistics, and general commerce.

Industrial License

This specific license is necessary for manufacturing, processing, and other industrial activities. An industrial license requires additional clearances from regulatory bodies overseeing environmental and health standards. And it best suited for companies involved in production and assembly within UAE-based facilities.

Tourism License

This license specifically intended for businesses within the travel, tourism, and hospitality sectors. The license covers activities such as travel agencies, hotels, and tour operators. It also helps ensure compliance with tourism regulations in the UAE, a major global travel hub.

Steps to obtain necessary licenses based on business type

To set up a licensed business entity in the UAE, follow these general steps:

- Submit an application along with relevant documentation to the DED or relevant free zone authority for initial approval.

- This initial approval indicates that your business type is acceptable under UAE regulations.

- Choose and register a unique trade name, following UAE naming conventions. Foreign trade names may require additional approvals and could add to the setup cost.

- Gather the required documents, including:

- Initial approval receipt and previously submitted documents

- A notarized lease agreement, approved by the Real Estate Regulatory Agency (RERA) if within Dubai

- A memorandum of association (MOA) or a Local Service Agent agreement, depending on business type.

- Depending on your business activity, you may need further approvals from specific government bodies. For example, tourism companies may require approvals from the Department of Tourism, while industrial businesses might need clearance from environmental and health authorities.

- Pay the licensing fee within 60 days of approval notification to avoid application expiration. License fees range widely, typically from AED 10,000 to AED 35,000 (approximately USD 3,6725 to 9,530,), though additional approvals or unique requirements may increase the cost.

- Once processed, the business license can be collected from the DED service centers or downloaded online. This document grants the authority to operate within the licensed activities.